Businesses of all sizes are always looking for ways to increase profits and grow their customer base. One of the best ways to do this is by implementing a payment processing strategy that works for your business. In this blog post, we will discuss different payment processing strategies that you can use to grow your business!

Increase profits and grow using these proven strategies!

1. Offer customers the option to pay via credit or debit cards

Credit and debit cards are a fast, convenient way to pay. They’re also one of the most secure payment methods around. Visa is so confident in their security that they offer cardholders $0 fraud liability protection for any unauthorised charges made on their account. That means you can shop with peace of mind, knowing that you won’t be held responsible for any fraudulent charges. So if you’re looking for a quick and easy way to pay, credit or debit cards are the way to go.

Learn more at Straal Payment Methods

2. Process payments quickly and efficiently

When it comes to processing payments, speed and efficiency are key. Anyone who has ever stood in line at a busy store knows the frustration of waiting for a slow payment system. In today’s fast-paced world, businesses need to be able to take payments quickly and effectively. There are a few ways to improve payment processing. First, streamline the checkout process by reducing the number of steps involved. Second, invest in high-quality services that can handle multiple transactions at once. Finally, make sure that your staff is trained and comfortable with the payment system. You can help ensure that your business can process payments quickly and efficiently by taking these steps.

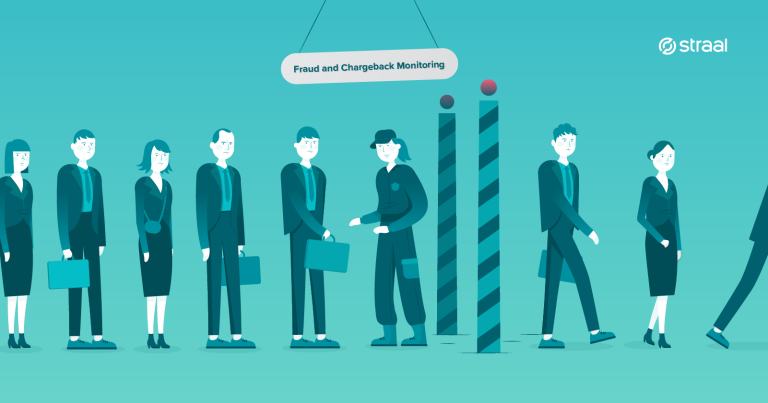

3. Use a payment processing company that is reputable

When it comes to payments, you want to make sure you’re working with a company that has a good reputation. After all, your payments are essential – they’re how you keep the lights on and food on the table. You don’t want to work with a fly-by-night operation that might disappear tomorrow, taking your payments with them. That’s why it’s essential to use a reputable payment processing company. These companies have a track record of success, and they’re not going to put their reputation at risk by disappearing with your payments. So if you’re looking for peace of mind, make sure you use a reputable payment processing company.

4. Make it easy for customers to make payments – have a transparent, concise payment process

That’s why it’s so crucial for businesses to have a transparent payment process – making it easy for customers to understand. When customers can make payments quickly and easily, it leads to greater satisfaction and loyalty. Customer satisfaction is more important than ever in today’s competitive market, so make sure your payment process is up to par.

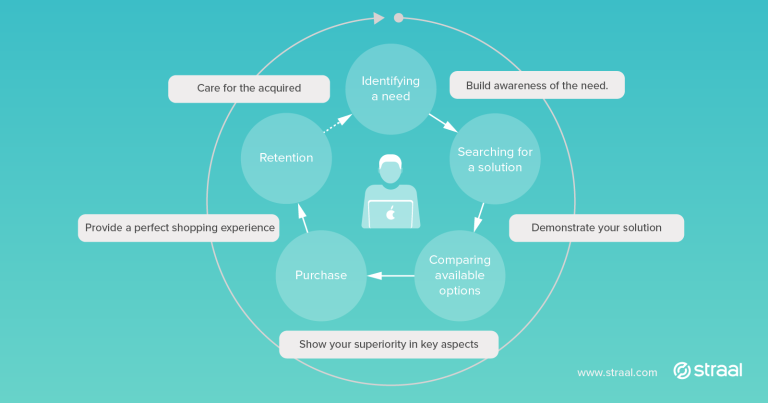

5. Educate your customers about the different ways they can pay for your products or services

When it comes to loyalty and retention, educating your customers about the different ways they can pay for your products or services is crucial. Consumers today have more payment options than ever before, and understanding all of their choices can be confusing. By explaining the pros and cons of each payment method, you can help your customers choose the option that best suits their needs. For example, if they’re looking for the most convenient way to pay, you might suggest they use a credit or debit card. On the other hand, if they’re looking to get the best deal, you might recommend using cash or a loyalty program. No matter their preference, taking the time to educate your customers will show them that you value their business.

6. Accept online payments from customers around the world

As a business owner, accepting payments is essential to your success. With reputable companies such as Straal, you can receive global payments in multiple currencies and offer local payment options.

7. Increase your local footprint

One way to grow your business is by expanding your local footprint. This can be done by partnering with local companies or opening up new locations. By doing this, you will be able to reach more customers and increase profits.

Tips from Forbes: 6 Effective Ways To Team Up with Local Businesses

8. Boosting Profits

Another way to grow your business is by boosting profits. This can be done by increasing prices or finding new ways to save money on expenses.

8. Increasing prices

By increasing prices, you will be able to bring in more revenue which can be used to grow your business. First, however, you need to make sure that you do not price yourself out of the market. If you do, you will lose customers and see a decrease in profits.

9. Saving on expenses

Finding ways to save money on expenses is also a great way to boost profits. There are several ways to do this, but one way is to use a payment processing company that offers discounts on transaction fees. This can help you save a significant amount of money over time in order to increase profits and grow your business.

10. Mobile Payments

Another great way to grow your business is by offering mobile payments. Mobile payments are becoming more and more popular, so you must provide this option to your customers. By doing so, you’ll be able to reach a wider audience and boost profits.

11. Reputation Management

It’s also essential that you focus on reputation management. This can be done by having quality content on your website and social media platforms. By doing this, you’ll be able to attract more customers and grow your business.

12. Loyalty Programs to increase profits and grow your business

Loyalty programs are a great way to encourage customers to return to your business. Offering discounts, points, or other incentives can encourage customers to continue.

The Harvard Business Review on How to Make Your Loyalty Program Pay Off

These are just a few of the many payment processing strategies you can use to increase profits and grow your business. Implement these strategies, and you’ll be on your way to boosting profits and attracting new customers! Thanks for reading!

Visit Straal.com

Start onboarding today!

Happy selling!

The Straal Payments Team

- The Payment Depot Team. Eleven Payment Processing Strategies to Grow Your Business: Part Two. (n.d.). Retrieved from The Payment Depot Blog:

- The eleven most effective payment processing strategies for businesses of all sizes | ThePaymentDepot.com Blog. (2017, December 29). Retrieved from The Payment Depot Blog:

- How do I expand my local footprint? | ThePaymentDepot.com