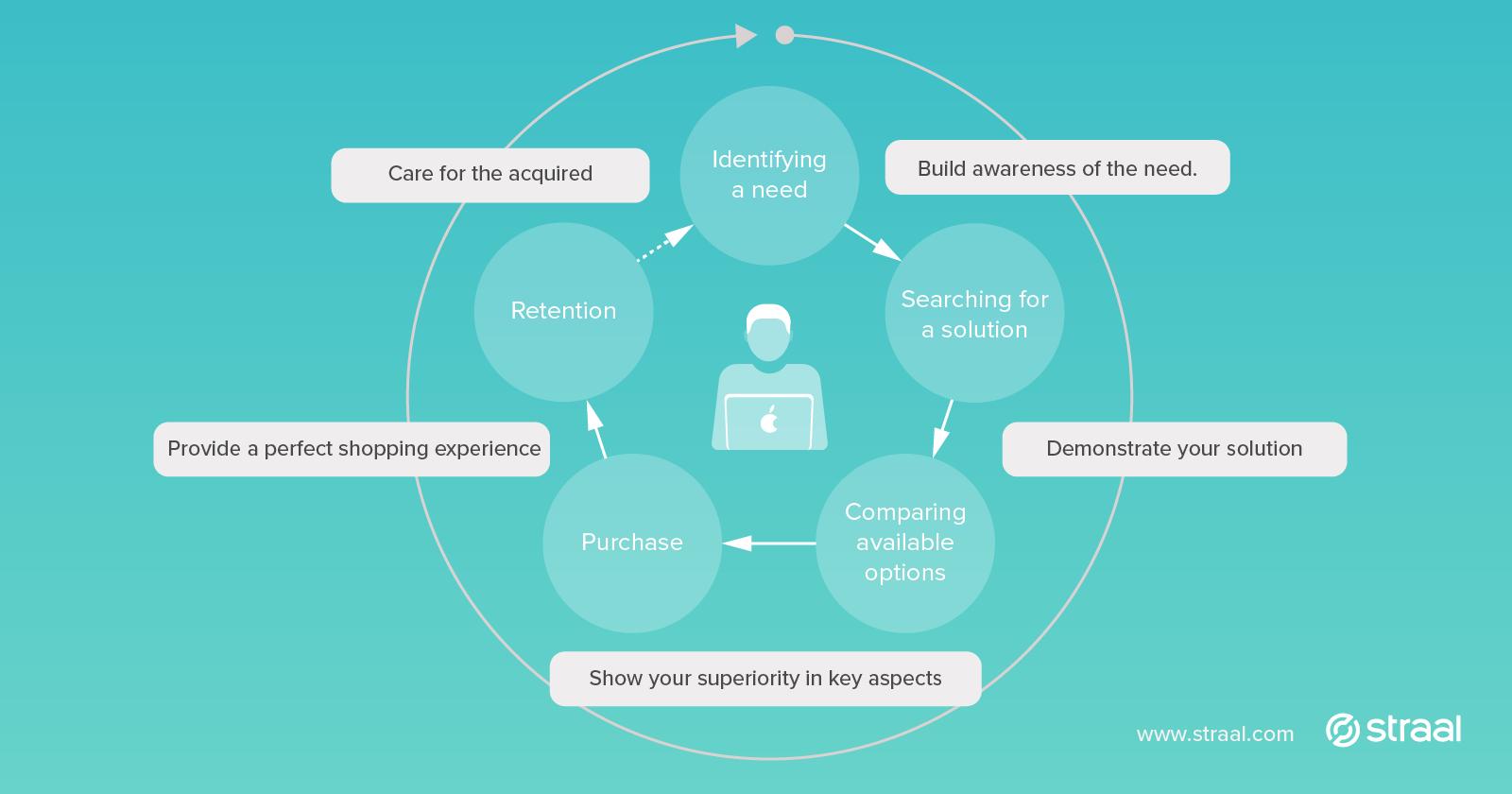

Despite the unquestionable uniqueness of every single customer, the purchasing process they carry out doesn’t vary so much from one to another. In fact, your subscribers’ behavior follows specific patterns. The marketing concept of customer lifecycle can help you improve your commercial effectiveness. Be it a tall funnel or a flywheel, it’s meant to systemize everything that happens from before the first “what is going on”, though some “aha moments” and a sealed deal up to brand advocacy.

The common definition of customer lifecycle describes it as the subsequent steps a customer goes through before, during and after purchasing a product/service.

These are usually assigned to the following stages:

- identifying a need,

- searching for a solution,

- comparing available options,

- purchasing a product/service,

- and, finally, retention.

1. Build awareness of the need (or the need itself)

The entire process begins once the client has identified and understood the problem they’re actually facing. The role of your company at this stage is, to make customer aware of this problem and help them understand it. For instance, a provider of a consumer mobile app helping people manage their home budget should at this stage explain their clients how much money and in what way they lose due to inappropriate financial management as well as indicate the actions they shall undertake to prevent further losses. This very first contact of the customer with the brand should leave the former convinced that they need a tool to manage their home budget. The way of presenting the problem in its various aspects will determine how they’ll approach the choice of the solution. Similarly, it will have an impact on what their attention will be drawn to at subsequent stages.

Once the client has understood the problem and identified the need…

2. Demonstrate your solution and remember: you only make a first impression once

At this stage, the customer is searching for a perfect solution that would fulfil their needs. Here comes your business: you present your offer and highlight your key selling points. The information transferred to the client at this stage significantly influences their attitude towards your solution and your brand in general, because earlier, the customer was focused on the problem itself.

Going back to the financial management app: previously, the client asked how to monitor their expenditure better. Now they’re reviewing the tool, wondering if the app’s functions will solve their specific problem, if data visualizations will be clear enough, if the interface will be intuitive, and so on. They will reach out to several providers, collect information about their products and compare them in particularly important aspects. Therefore…

3. Show your superiority in key aspects

At the comparing stage, you compete with your rivals directly. Now, the customer is looking for alternatives to the solutions recognized at the search stage, defining their priorities, making a detailed analysis of the available options, and confronting the information provided by various companies with their expectations and wants. When contacting clients that have already entered the comparison stage, the role of your business is mainly to expose your advantage over competition (especially in the aspects important for your customer).

When it comes to the financial app, if the actions are targeted at a properly selected audience, the solution provider knows e.g. that their average client has multiple subscription liabilities, likes to shop online and pay by credit card. That’s why the app creator will expose its unique subscription payment system or the ability to display the merchant’s logo next to every single transaction to make it easier for the user to identify every penny spent in a given period.

If everything has gone smoothly so far, now…

4. Provide a perfect shopping experience

Purchase is the crucial moment. The client has chosen one solution from the available options, so it’s tempting to think that the only step left for you is “merely” not to spoil anything now, right? Well, not necessarily. As practice shows, it is exactly this stage at which clients resign from the purchase most often (the infamous e-commerce “cart abandonment”). Your challenge at this stage is to make the purchase process as simple and seamless as possible: minimum formalities, non-absorbing payment, clear messages indicating what’ll happen at further stages. If something goes wrong here, the client will go back to the comparison stage and exclude your offer from it. In the case of the financial app, it suffices to make the user verification process complicated and time-consuming to make them drop the idea of signing up.

Let’s assume we’ve made it. The client has made the purchase. Now, let’s leave the financial app example and go to your subscription business. The client has become a subscriber of your service. Congrats but don’t rest on your laurels. The ease of making the purchase often equals to the ease of switching to another provider – your competitors also care about the simplicity and comfort, aiming at maximizing conversion. It’s easy to notice that when losing an acquired client, we lose not only potential revenue but also the resources invested in acquiring them (including all the actions thanks to which you managed to finalize the stages mentioned before). Due to that, now…

5. Care for the acquired. Effective retention is at the very heart of the subscription model

At this stage, the client’s already using your service and… assessing the purchase decision they have made. They take into account both the product and the whole experience connected with its purchase and usage. Their overall satisfaction is influenced by e.g. the availability of materials explaining how to make the most of the solution, what to do when facing problems, etc. The provider is responsible for making the acquired client satisfied, and, as a result, willing to buy additional services/products as well as recommend the offer to others.

When working in the subscription model, retaining your clients becomes one of the most important marketing tasks as subscriptions base on the existing customer base, not the potential ones. Nevertheless, investing in this field of business activity pays off: retaining an existing client can be from 5 to 25 times cheaper than acquiring a new one. To learn more about the subscription model and the role of customer retention in it, read through this blog entry.

Customer lifecycle in your business

Monitoring your customers’ lifecycle is rewarding – if you adjust your marketing and sales strategy to the stages described above, your actions will become more effective and targeted more accurately. It’s worth remembering about all of them without omitting the last one, i.e. retention, especially if you run your business in the subscription model. Effective customer retention not only makes your clients satisfied but also encourage them to recommend your brand to others. And that makes the tough task of acquiring new customers easier!

If you have any other questions regarding customer lifecycle, feel free to contact our team!