Consumer habits have been changing rapidly for over a year now, so the payment industry is evolving with them. The question is: how to lead business through this landscape efficiently? This is where the recurring business model steps in. Flexible and incredibly beneficial for both B2B and B2C companies: from subscription music services to software houses offering products for businesses.

Are you a small business owner looking for a way to approach new clients and prolong the life cycle of the ones you already have? Or maybe you have heard about recurring payments but don’t really understand them? We’ve got you covered.

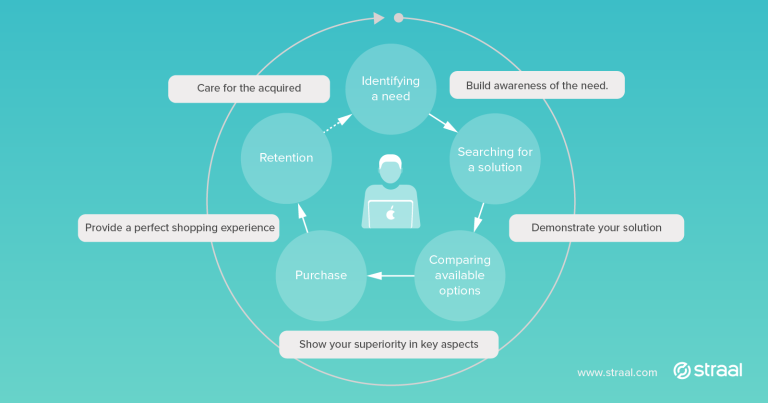

Nowadays, business owners need to focus not only on transactions and adopting new technology but especially on building and obtaining relationships with their clients, putting them first with customer-centricity in mind.

Recurring payments are a perfect choice for both customer and merchants for these types of services that are being purchased repeatedly (out of need or loyalty). Over 80% of merchants agree that recurring payments allow to build better customer relationships due to increased contact and 70% of business owners claim that models based on recurring payments are the future of further commercial growth.

Another study showed that 65% of UK homes are signed up to regular subscription services with an average of 7 contracts (per household!).

Recurring payments: a definition

Recurring payments are a payment method in which a customer authorises a merchant to run repeated payments on a predetermined schedule – it could be yearly, monthly, quarterly or even daily. Unlike in-store purchases, a customer does not have to be physically present while making a purchase. These payments occur remotely.

Depending on the product, there are two types of recurring payments: fixed and variable.

- Fixed (or regular) – a customer pays the same amount each time a payment is made. For example, for a monthly gym membership

- Variable (or irregular) – a payment amount depends on individual usage of the services that were provided during the payment cycle. For example: electricity bill

Other popular types of recurring payments are: household bills, personal finance assistance etc.

You are probably familiar with the “subscription payment” term. Well, it’s also an automated payment processing system but gives even more flexibility and might be extremaly valuable. The consumer can choose from various products and switch between them. Subscriptions are perfect for ‘entertainment’ services like Netflix or Spotify premium plans or SaaS like Perfect Gym of WooCommerce. Most of them allow fixed payments (on a monthly basis).

How do recurring payments work?

A simple scheme

There are many different payment processors that have recurring payments in their portfolio with various workflows but usually they follow these steps:

- A consumer chooses the recurring payments mode or a subscription product on your website.

- Fills out a simple and short form in order to create an account.

- Then is redirected to the checkout page for card verification where the customer enters their card details. The data is then fully secured and saved in the payment gateway page.

If the verification is successful, you have a new subscription!

A payment cycle will continue to renew e.g. on a monthly basis until the customer decides to cancel it.

How can recurring payments benefit your business?

- Increase your base income (monthly revenue)

- Attract potential customers by offering trial access to try out your product

- Increase your customers loyalty – recurring payments are incredibly convenient for customers: they don’t need to enter their payment details every billing cycle and there is no need to set up reminders to pay the bills: it’s all being made for them automatically. That ensures a healthy customer-merchant relationship.

- Make savings in operational-logistics costs due to predictable demand. You, as a business owner, cut down the cost and effort associated with payment processing and invoicing. Just set up a payment plan once and let the software handle the processing for you.

High quality anti-fraud protection – payment gateways that process recurring payments (and store the payment details received from customers) must secure their servers using the most advanced methods like tokenisation. Moreover, they absolutely need to be PCI DSS compliant – e.g. Straal holds PCI DSS certificate 1 (the highest available).

Which industry is the best for recurring payments?

Recurring payments can be used broadly because they drive growth in many different industries covering every size and type of the business. Here are just the examples of the industries that may benefit the most from recurring payments:

- Membership businesses – when a fixed amount for the membership is charged (monthly or yearly). Examples: co-working spaces, educational courses and gyms

- Subscription businesses – from streaming services (like we mentioned earlier: Netflix, Spotify) to SaaS companies (WordPress or Adobe)

- Financial services – perfect for personal finance where the selected amount of money will be automatically transferred from the customer’s account to e.g. the insurance company.

- Utility providers – it’s a convenient way to pay taxes or bills like electricity, water, mobile phone etc

How to set up recurring payments if you’re a small business owner?

Recurring payments are processed electronically, that’s why as a business owner you’ll need a merchant account (a bank account where funds are deposited but solutions for processing and securing are not included) or a Payment Service Provider (PSP) such as a payment gateway, who handles crucial aspects of electronic payments: from processing to security.

What to look for in a recurring PSP?

- Easily accessible management system – which will show you the processed volumes, the number of transactions and basically all the required data

- Support – in case you’re unsure or need support – there should be someone from the PSP ready to help you.

- Invoicing capabilities

- Security – PCI DSS compliance certification means that the Payment Service Provider meets the highest industry standards about storage of sensitive data including credit card data. For example: Straal uses tokenisation technology as part of our Recurring Engine software – it means, it is stored securely in token form. When it comes to PCI DSS, it’s a certificate that every merchant accepting credit cards must be compliant with. It was created to enable a high and consistent level of security in the ecosystem where cardholder data is processed.

- Solutions preventing card declines – Sometimes your payment is declined due to various reasons and every charging attempt is a cost for you, as a merchant. Moreover, from your customer’s perspective, an unsuccessful subscription fee results in subscribers’ frustration. That’s why in the payment industry there are several ways to prevent card declines automatically. These tools work perfectly and don’t hinder everyday business activities. Straal offers two tools that aim to increase the effectiveness of charging subscription fees from credit and debit cards. We can automatically retry failed subscription transactions for you, as our merchant. Furthermore, it helps merchants retain customers by reducing passive churn. If you want to learn more about the mechanisms, check our video explainers below:

6. Risk management – your recurring payments provider needs to own advanced risk management mechanisms that result in maximisation and stabilisation of your profits.

Are you ready to start enjoying the benefits of recurring payments?

Increase your revenue up to 20%! Reach out to us via [email protected]