Whilst Black Friday and Cyber Monday, or “Black Friday Weekend and Cyber Week” do not mean as much as, say, 2-3 years ago and according to experts in 2020 we’re experiencing „the lockdown effect” which means lower interest and less overall spend, the pre-x-mas shopping spree is still among the key determinants of the thickness of your top line. Even if you sell digital goods or subscription plans. Here’s how to – in the realm of intangible merchandise – make the most of all holiday season sales even though this time – due to the COVID-19 – is going to be like no other.

1. Use the holiday shopping season as an up-selling and cross-selling opportunity

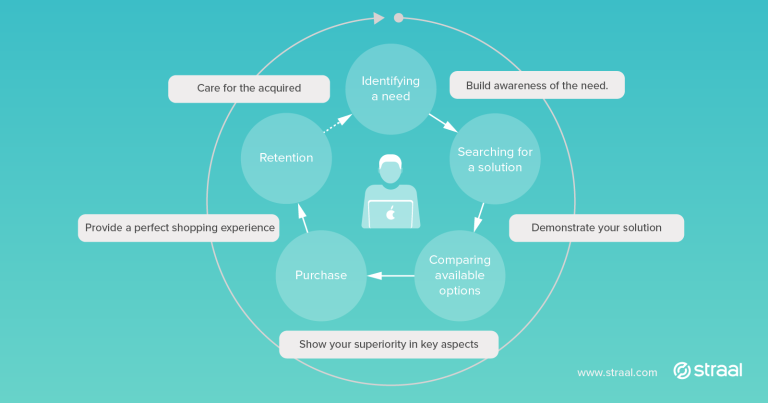

Although customer acquisition is among your top tasks and the “Number of users” bar plays a key role in your mid-term effectiveness assessment, mind that in the digital goods/services commerce your customers are seldom one-time shoppers and therefore customer LTV (CLV) is far more important than profit from a single purchase.

Let’s clarify the basics first. Upselling is encouraging the purchase of anything that would make the primary product/service more expensive. For instance, a single-device software license might prompt the suggestion for a “Family” multi-device license. Cross-selling, in turn, is the suggestion of any other product to be purchased in conjunction with the primary product – a wellness plan suggestion when a gym subscription is purchased, for example.

When operating in the subscription-based model, you sell long-term relationships, not just items. You aim to increase your recurring revenue without noticeably increasing the average customer acquisition cost (CAC) nor the average recurring cost of service per customer (ACS). Joel York explains it clearly in one of his blog posts. When you sell subscriptions for digital services, your margin is usually quite thick, so the latter is not hard to do. The former, however, might be quite a challenge in the holiday season – when your competitors are investing in acquiring the same target group. What happens to be the most reasonable path is making the customers you’ve already acquired purchase more. In other words, think primarily about those who are most likely to pay and stay – your current active users. Offer them a temporary upgrade to premium for a fraction of the regular price or some exclusive holiday one-off deals. This will increase their satisfaction, loyalty and – in a long-term perspective – profitability (LTV). This will make the next step much easier.

2. Acquire new users through steep discounts and gift cards, and don’t let them churn as soon as the prepaid plan is over.

Easier said than done, right? This point includes actually 3 mutually reinforcing elements. Steep discounts, one-off promotions and buying gifts for the holidays are what motivates consumers to buy things during the BF/CM shopping season, according to McKinsey. And when you sell digital goods, your price-slashing capability is far greater than in the case of any physical merchandise. Gift cards and discount codes are the way to get you plenty of new users, especially in the holiday season.

Gift cards are the #1 requested presents during the holidays. Moreover, according to some reports, in the case of one-off purchases, 65% of gift certificate recipients spend around 38% higher than the face of their cards.

For subscription-based merchants this translates into significantly higher chances for customer acquisition once the prepaid plan is over. But you need to sell those cards first. And, once again, your current active users play a key role in the process. People who use and enjoy your product, who trust you, are far more likely to buy and give someone your gift card as a present than people lured by, say, an ad-hoc external ad campaign. Remember the importance of customer LTV? Unfortunately, traditionally understood lifetime value of customers acquired through gift cards is close to null – because their plans have already been paid for. However, their above-average likeliness to convert into paying customers is of unquestionable – though hard to estimate – value. And by selling gift cards/codes primarily to your current users, you can keep the CAC low. But you need to convert the recipients of gift cards into regular, paying customers quickly.

3. Use the holiday shopping season to run a referral program.

That’s a good reason to introduce a well-thought referral program. Your current active users are mercenary – profit-driven – and offering them some extra benefits for bringing you quality customers should do the job. The Lifetime Value for new referral customer is 16% higher than non-referrals, according to stats. You can double or even triple this value, but your recommender program must go beyond rewarding just for sending invitations to your service. You need to make your active users care about the future of users they help you acquire. You can, for instance, introduce rewards (i.e. discounts) for recommenders for specific actions taken by users they bring to your service. Don’t confuse it with MLM. It’s all about the optimization of the customer lifecycle. As a digital goods merchant you can do it much easier than brands who sell physical goods. Simply put, if it works for Tesla, it’s even more likely to work for you.

Moreover, the rewards for recommenders might work as an additional cross-selling tool. Imagine the following scenario. You run a VoD platform. One of your users buys a gift card for a friend because he’s been told that once the friend converts into a paying customer, he (the recommender) will receive a 20% discount on his next annual subscription plan and exclusive access to a VIP zone. In the VIP zone, he can, in turn, get some exclusive deals unavailable for regular users. So, while enjoying his VIP status, the recommender buys even more. Such a program might attract not only legitimate users but also some fraudsters, so you need to smartly mitigate the risk. Therefore…

4. Make sure your Payment Service Provider takes care of fraud detection and prevention during the holiday season.

The “F” word seems to be on everybody’s lips these days. Because of fraud, holiday shopping season might be a threat for your business as it is an opportunity. According to statistics, E-commerce fraud rose by 22% during the 2017 holiday season. That’s because the more traffic and higher transaction volumes, the more difficult it gets to spot fraud attempts and react.Behind the term “fraud”, there’s actually a plethora of threats. Payment fraud, friendly fraud, affiliate fraud, promo abuse and so on. You can learn more about fraud from one of our blog entries published earlier this year. To cut a long story short and set in the context, there are two things you need to understand regarding fraud in the holiday shopping season:

- fraudsters love to hide in crowd,

- sometimes even legitimate users commit promo abuse or demand chargebacks.

Both kinds of extortion can be effectively prevented, once appropriate technical measures are taken on time. Quality FDP systems not only spot fraudulent transactions but also can help you mitigate the risk brought by your referral program. Before the sale season kicks-off, ask your PSP how their system protects you against criminals and slyboots. Should this make them palter and mumble, either search for a quality FDP system on the market (integrating it with your PSP might cost you) or find a PSP who offers top-class FDP as a part of their suite of solutions.