Recently Straal and Fundacja Digital Poland with Visa have published the Mobility as a Service 2020 edition report. It’s the second edition of the cross-sectional report about Polish and global condition of the Mobility as a Service 2020 market. Take a look at the key highlights from our report!

What’s in the report?

- A comprehensive analysis of the Polish MaaS market featuring expert commentaries

- Data from a consumer survey conducted in 2020 (just after the lockdown due to the COVID-19), over 1000 respondents (18+) on behalf of IQS (via Fundacja Digital Poland)

- Thorough analysis of customers’ behavior (pre-, during and post-march 2020-lockdown), payment methods, customer’s finance and the future of MaaS industry

- Innovative solutions, barriers to development and the key problems of the Polish market, such as lex UTO and lex Uber

In this post, we decided to present the key highlights from the report. If you’re interested in getting the full (and free) version CLICK HERE. And if you want to take a deep dive in the world of MaaS industry, take a look at our previous Mobility as a Service report, where you can explore available services, find the basic knowledge – download for free.

Customer survey: general state of MaaS

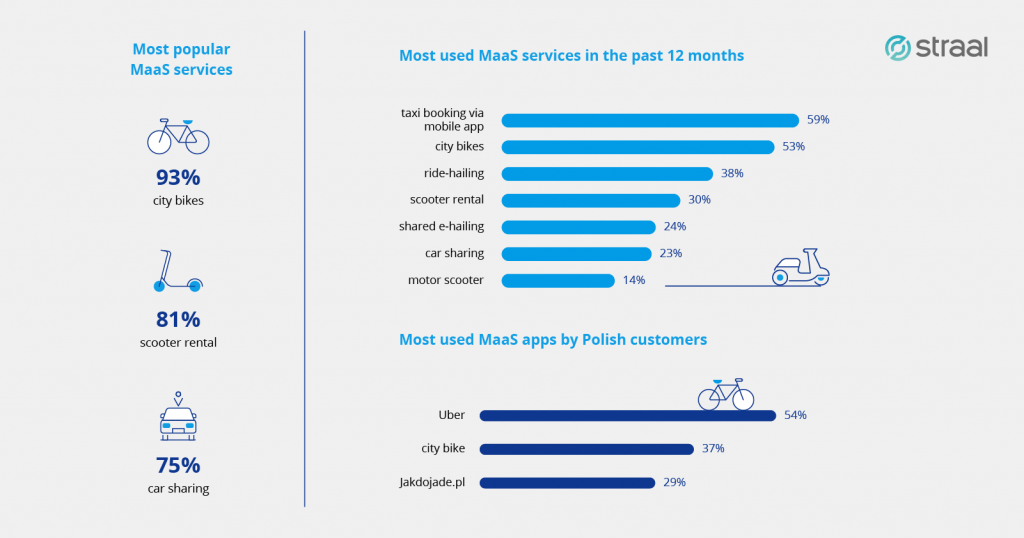

- Bikes and scooters are the most popular MaaS categories

- Most used services (in the past 12 months): taxi, city bikes, ride hailing apps

- Most used apps are Uber, City Bikes, JakDojade.pl

Customer survey: effect of the pandemic

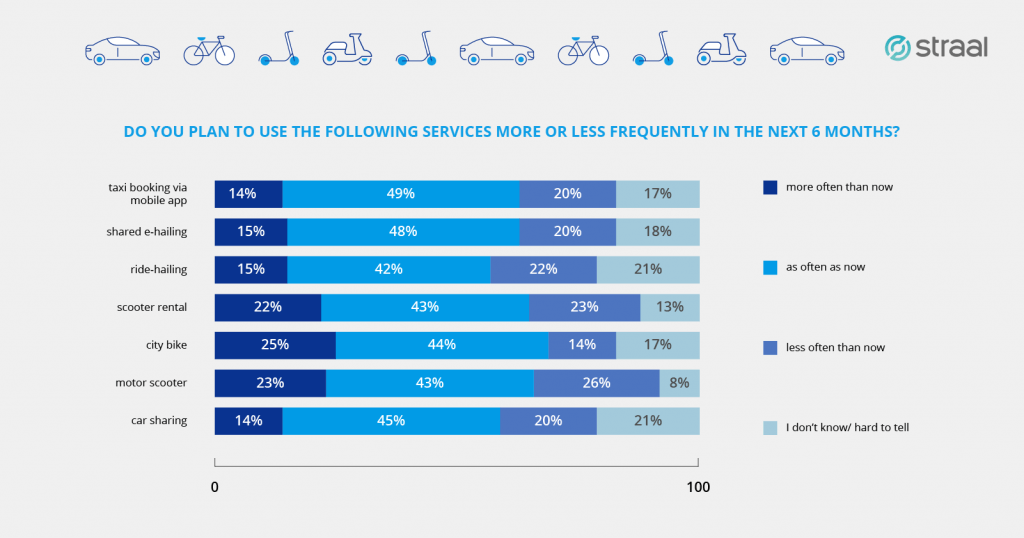

Consumer priorities shift as concerns about pandemic raise: more people declares they will use city bikes more often after the pandemic. For other services – just the opposite.

Customer survey: outlook about the future

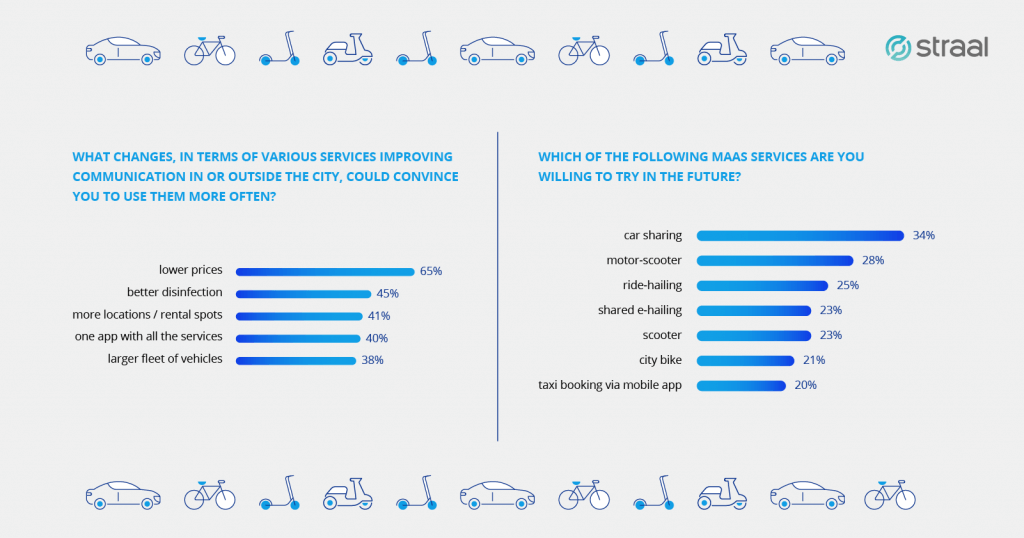

In general, Poles aren’t afraid of MaaS (even considering the pandemic) but lower costs, disinfection and one application to access all services can convince people to use it more often. Poles are willing to try more car-sharing and motor scooters in the future.

Customer survey: finances

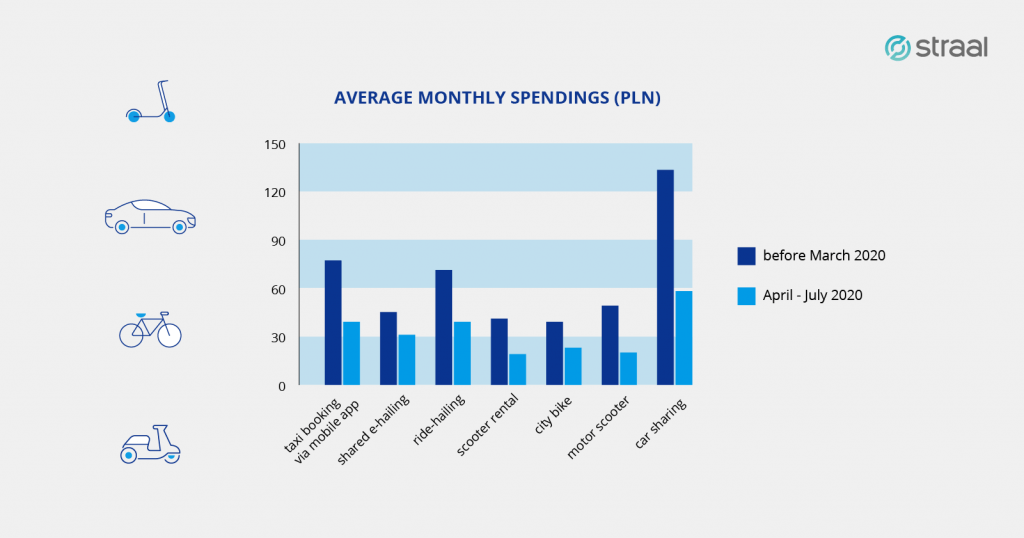

The pandemic reduced MaaS expenses by nearly 50% in all categories. Note: in our customer survey we also took into account June and July, when the restrictions in Poland due to COVID-19 were already smaller.

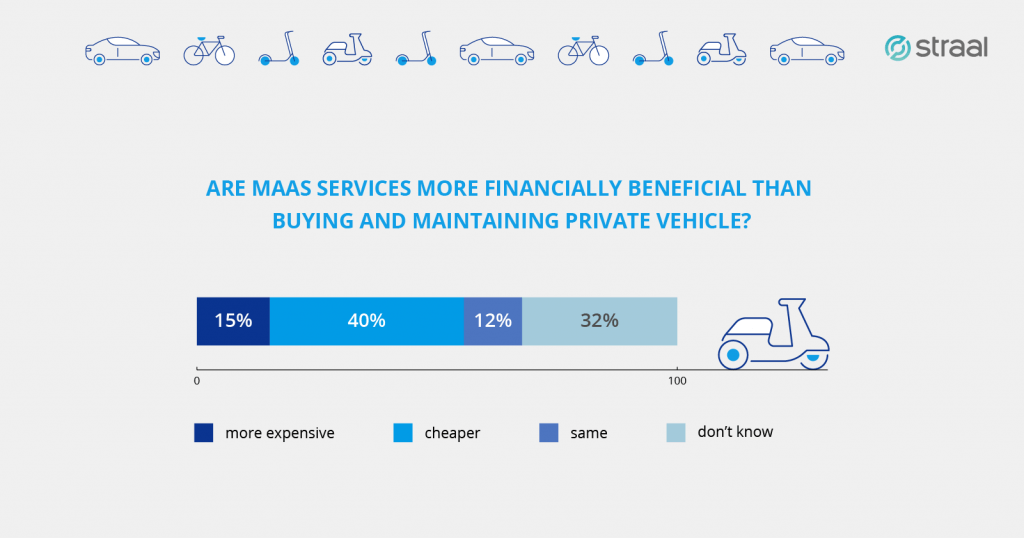

Customers find MaaS services in Poland more financially beneficial than buying and maintaining private vehicle.

Customer survey: preferred payment methods

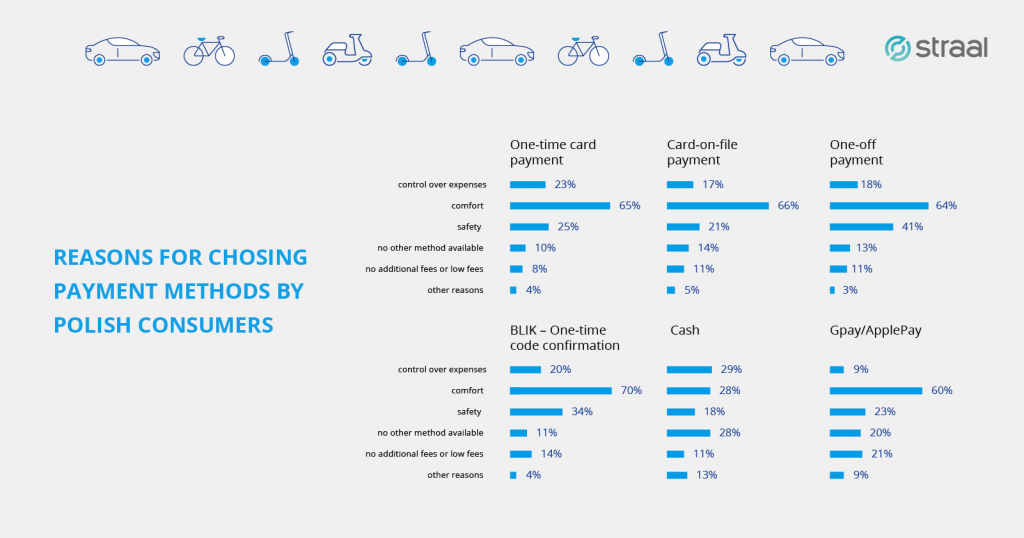

- Modern payment methods are mostly chosen because of convenience and security

- Poles prefer to pay by card, even though they see it as less safe than other payment methods

- Cash is the most popular among ride-sharing services, as consumers still see it as a way of giving them increased control over expenses

Do you want to know more?

- CLICK HERE and download Mobility as a Service 2020 report!

- Check our previous MaaS report here

- Explore Knowledge Hub and find more insightful publications, white papers, reports and more!