Online payments are a must-have in the e-commerce world. Period. The times when you gave the clients your bank account number are far behind us. Once you find your perfect-match payment service provider, you should prepare your website/application for accepting online payments. Why is it so important and what to keep in mind while getting ready? Scroll down to find out!

The e-commerce market is growing at an astounding pace (and is expected to hit $4.5 trillion by 2021) so it’s not a surprise that you want to take advantage of this lucrative business opportunity. As you already know, starting an online business comes with a couple of technical issues. Choosing and integrating a payment gateway is one of those (we’ve already covered the choosing part: read about it here). In theory, it’s not indispensable but… do you remember the last time you had to make a transfer manually using a merchant’s bank account number? Me neither. In today’s e-commerce, no one forces their clients to do it. From the UX perspective, it’s a bad practice and harmful to your business, as it increases cart abandonment rate significantly.

Nonetheless, contracting a payment service provider is not as quick as it may seem at first glance, no matter what some of those tell you. Before signing the contract, the PSP verifies:

- your company: whether you run a legal business with a clear structure and a transparent offering (we’ll cover this in one of our future entries),

- your website: whether its design and content are suitable for accepting online payments and if so, on what conditions

You’ll have a chance to collaborate with your chosen PSP only if your business undergoes the verification processes successfully and provides acceptable risk level for the PSP. But these are not payment gateway providers who make the rules: these restrictions are imposed by card schemes (such as Visa or Mastercard) and acquirers (if you’re not sure what they are, jump here). However, it is the PSP that “pre-checks” if you comply with them before they send your application to an acquirer. That’s why you should take care of your website before contacting such an entity.

Why Prepare Your Website for Online Payments Beforehand?

When you’ve finally made the decision to start your own business – or move an already existing one online – you probably don’t want to waste your time on things of minor importance. You’re focused on your product, its logistics, marketing, and other business issues. I fully understand that contracting a PSP is not the most exciting thing you might think of right now.

But, all in all, you must integrate a payment gateway. If you want to keep this process as short as possible, it’s recommended to prepare your company and the website, too, before the PSP starts the preliminary verification. This way, it’s going to be much faster and you’ll be able to start selling online sooner. If, by turn, you don’t do this and the PSP tells you that your website needs some fixes, you’ll prolong the process unnecessarily. To start selling online as soon as possible, prepare your website beforehand.

How to Prepare Your Website for Online Payments?

If you want to save time and prepare your website for accepting digital payments before you contact the chosen PSP, the easiest thing to do is to go through our checklist and see if you meet all the criteria pointed out there. As you may know, PSPs collaborate with diverse acquirers. The requirements that acquirers have regarding websites differ from one to another but, generally, they come down to the same issues. Further on, I enlist them, specifying the general, most important requirements common for all acquirers.

When modifying your website to accept online payments on it – or designing a new one compliant with the rules mentioned above – you should take the customer-first approach. Card schemes and acquirers want e-stores to be transparent and reliable for the end client so that they know what kind of company company the seller is, what product it offers and what the conditions of the purchase are. They forbid misleading consumers or leaving them with too many unanswered questions. As long as the website designer is directed by this basic rule – transparency – it’s very likely that no changes will be necessary once the website is verified.

Now, let’s delve into how you should prepare your website for accepting online payments.

1. SSL certificate

Can you tell the difference between http and https at the beginning of your URLs? That’s right, it’s the SSL certificate and data encryption (if you’re not familiar with the term, jump here). For the sake of online payments security, e-stores are obliged to hold a valid certificate. Currently, SSL is quite common and you can seldom see websites without the final “s” in the URL but it happens, so keep it in mind.

When preparing your website for online payments, double-check your SSL certificate.

2. Website Layout

Back in 1999, Jakob Nielsen, a co-founder of Nielsen Norman Group, labelled design quality as one of the key website trustworthiness factors. Although 20 years have passed, this truth is still valid. Website design trends change over time and it’s definitely worth monitoring them: obsolete websites discourage consumers from exploration, the result being high bounce rate. Although the 90s-like looks are trendy again in the fashion realm, what comes to your mind when you see a Microsoft-95-like web layout?

If you want your website to be trustworthy, remember to keep its layout up-to-date. Follow web design trends, especially in terms of website navigation and the use of subpages.

3. Website Navigation

Your website should be easy to navigate. It means that its structure should be clear for the user and that they should be able to move from one site to another without problems. It must enable them to return to the home page and go to their shopping cart at any time (using a small cart icon in the top corner is highly recommended). Also, they must be able to see the hyperlink to terms and conditions on every site.

Creating empty subpages or having subpages with errors (such as the infamous 404 “Not Found” one) is something you should avoid at any cost. They decrease the trustworthiness of your website and make the PSP think that you intend to mislead your clients.

To make your website payment-friendly, work out the best, most intuitive subpages structure and remember about including hyperlinks to the most important places on each of them.

4. Company Details

Customers should be able to identify the company behind the e-commerce brand and website instantly. Because of that, you are obliged to provide them with your company details such as its:

- full name,

- registration address,

- phone and/or email address,

- registration number.

This information should appear in at least two places: terms and conditions and website footer or the “contact us” bookmark. It is also highly recommended to use your company’s logo.

When preparing your website copy, remember to include the company details.

5. Offering Description

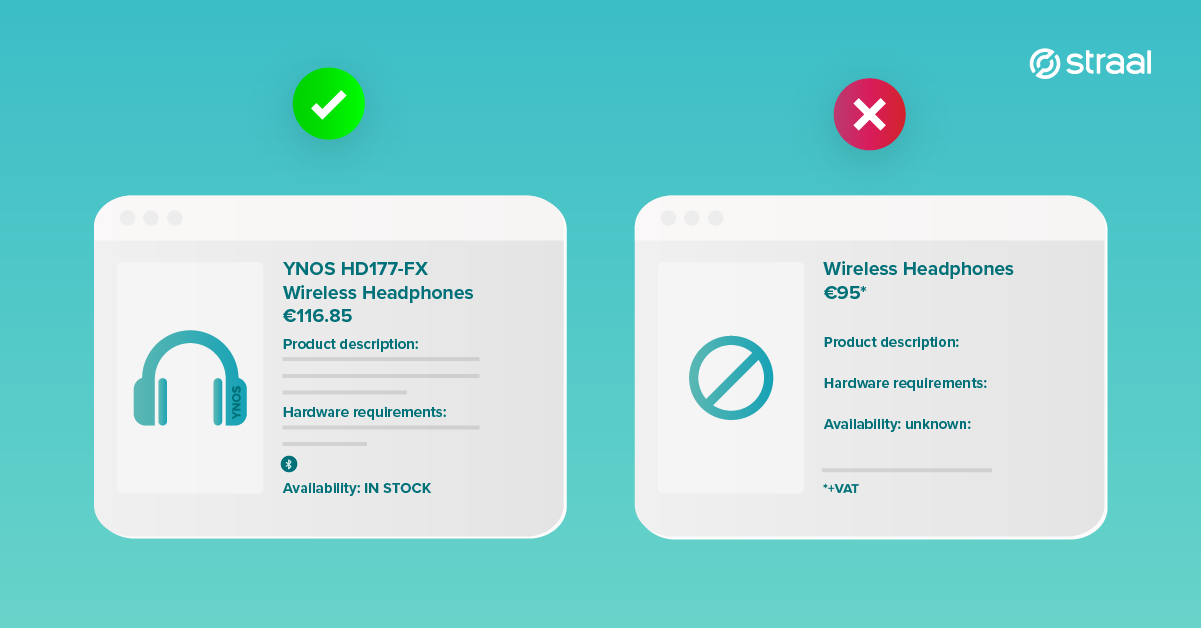

No matter what you sell – be it lunch boxes, VoD access or LPs – your client must receive a complete, detailed description of your products. It cannot be misleading or lack substantial information. For instance, if you offer physical goods – say, vintage clothes – a product page has to specify the piece’s name, its price, and all meaningful physical traits (e.g. size, colour, and material). Don’t forget to upload the product photos, too – if you don’t, your e-store will be much less reliable. In addition to the product itself, you should provide information about delivery (terms, price, and time).

If you sell digital product subscriptions – such as monthly music streaming – you also have to provide your clients with a detailed service description so that they know what they purchase. Such description should include information about the subscribed product, dates of subscription fee charging, and cancellation procedure. It’s worth mentioning that in the case of subscriptions, terms and conditions tend to be longer than in the case of physical goods. If your offering includes various pricing plans, the difference between them must be clear (feature lists are a popular solution).

Regardless of the product form, its price has to be 100% clear before the client makes the purchase. If you operate on multiple markets, it’s recommended to provide multi-currency price information (merchants usually make use of ISO 4217 codes).

To start selling online ASAP, remember about detailed, transparent product or service description and pricing.

6. Terms and conditions

Every e-store has to feature clearly stated terms and conditions. To start accepting digital payments, your website has to include this kind of information. Be they a subpage or a downloadable file, terms and conditions must be informative and make your clients understand their rights and obligations. And, as stated before, they should be accessible from every subpage.

Keep in mind that your terms and conditions should provide information about your:

- privacy policy: answers to questions such as what customer data your company stores, in what way and for what purposes,

- refund policy: the terms of returning your products or getting a refund,

- termination/cancellation policy (when selling products in a subscription-based model): the terms of the subscription cancellation.

If you want your website to be verified by the PSP successfully, pay special attention to terms and conditions.

7. Purchasing Process

When it comes to the overall shopping journey of your customer, every step they make to finalize the transaction must be clear for them. These include e.g. adding products to the shopping cart, choosing the delivery method, summarizing the purchase, and making the payment. No matter the step, the customer should know how to proceed or resign from the transaction. This is the reason why the shopping cart icon mentioned before is recommended: it enables your customer to jump to the purchase stage any time.

The purchase summary needs to specify all products added to the shopping cart, their unit price as well as the delivery method and its cost. It’s is strictly forbidden to add extra costs after the summary is shown to the consumer.

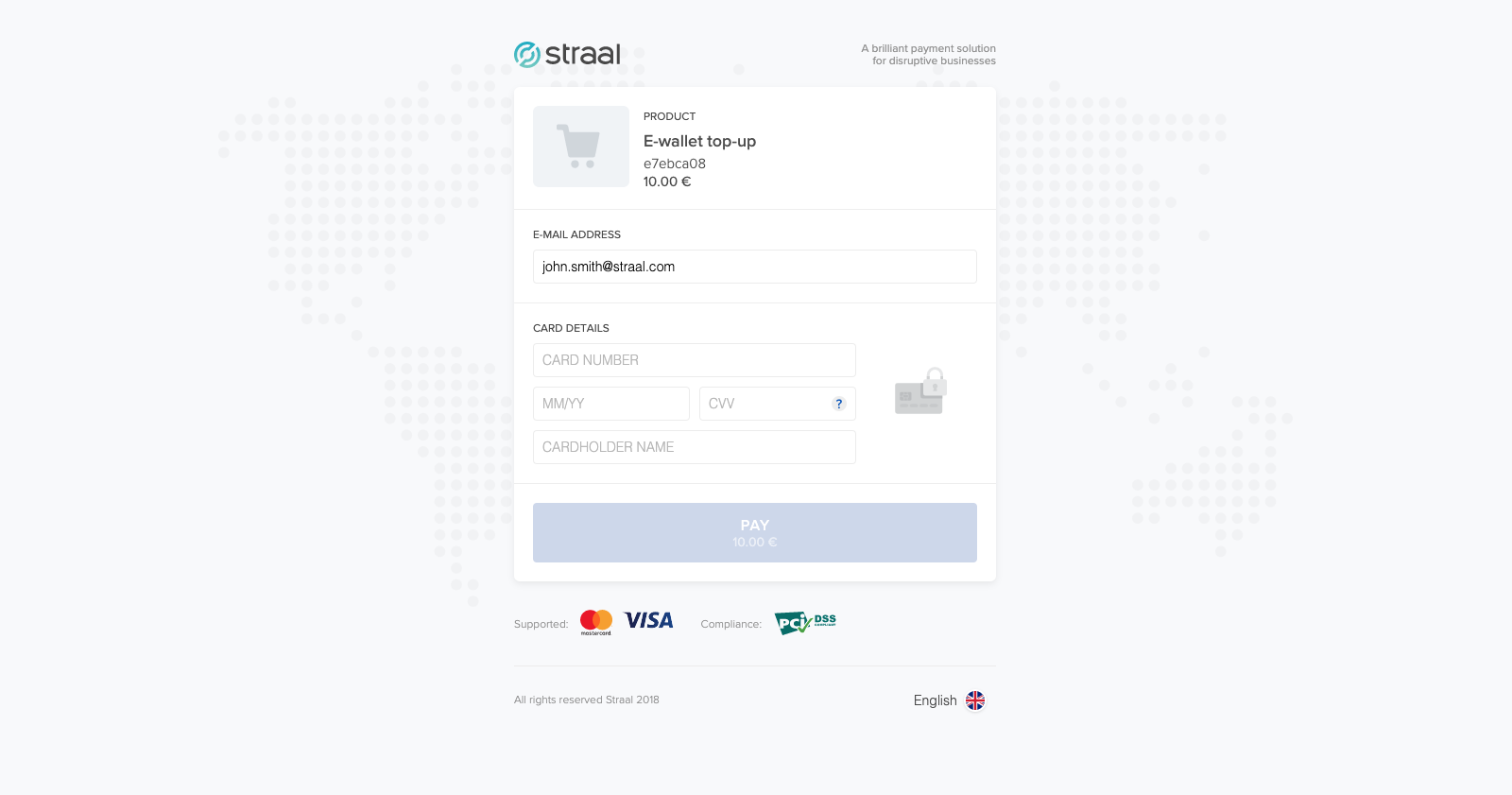

The information you provide your customer with at the online payment stage is also crucial but it’s not really verified by the PSP – all in all, it’s the payment service provider that should take care of it once you sign a contract with it. That’s what happens, at least, if you make use of a hosted checkout instead of an integrated one (learn about the difference in this entry). If it’s hosted, the PSP makes sure that all the necessary information is included on the checkout page.

When collaborating with Straal, merchants don’t have to worry about the checkout page compliance. Our hosted checkout includes all the information required by digital payments regulations and is always up-to-date so you don’t have to track legal changes yourself. Additionally, our UX and UI designers have optimized it to be fully intuitive and customer-friendly.

Make Your Website Payment-Friendly Today!

If you follow our simple guide, you’ll prepare your website for accepting payments in no time. Nonetheless, remember that your business will undergo a verification process as well (if you want to get ready for this, too, stay up-to-date with our blog). Once you succeed in both, you’ll be much closer to launching your e-store or online service point. And the rest is your bright future!

If you still have any questions as to your website’s payment-readiness, we’ll be happy to help you. Just send us a message any time or take a look at other entries on our blog – maybe they’ll dispel your doubts!