In the face of Subscription Economy, offering your merchandise in the form of a subscription-based service may seem an alluring opportunity: all in all, in recent years, the subscription market has been growing at an astounding pace of 100% YoY. Before you pivot, however, it is worth getting familiar with technology designed to make recurring payments more effective. Here comes Smart Retry: a solution aimed at increasing card authorization rate. How does it work and why should you implement it in your subscription business? Scroll down to find out!

There are two basic types of billing in e-commerce: one-off and recurring. Subscriptions, defined by InvoiceBerry as an agreement on the basis of which customers receive and provide payment for regular product or service delivery, fall into the second category.

Recurring payments may be executed at the beginning or at the end of each billing period.

- In fixed-fee models, the customer pays a fixed fee in advance and payment is the condition of getting access to the service or product (as in the case of VoD platforms or press subscriptions).

- In pay-as-you-go models, the subscription fee reflects the actual usage of the service or product and is charged after a predefined period (as in the case of telecoms).

There are literally thousands of payment methods available for customers to carry out their subscription payments with (Michał Jędraszak explains various alternatives in one of his entries). Nonetheless, as customer experience online depends heavily on the convenience of the checkout process, fixed-fee subscription services typically take advantage of card-on-file payments (statistics show that cards are the preferred payment method for app. 70% of consumers worldwide). You might know this one well from Netflix or Spotify. From the subscriber’s perspective, it consists of charging their credit or debit card automatically in previously predefined cycles. As card data is saved in the system and stored securely, there’s no need introduce it more than once. Cards are then automatically charged by the PSP without the customer lifting a finger. At the merchant’s end, it’s more complicated, though. PCI Security Standards Council established a set of standards with which card-on-file payments collecting must be compliant. Typically, it’s the PSP who holds a PCI certificate and thus is responsible for card data security. In such case, when the merchant wants to charge a card, they merely send a token to their PSP. Consequently, it’s the PSP who’s responsible for vaulting card details, not the merchant. If, by contrast, merchants don’t collaborate with PCI-certified PSPs, the responsibility is at their side, which makes the payment process even more complex for them. Unless it’s a large company with really big transaction volumes, it simply doesn’t pay off. Thus, the need to make use of a certified payment gateway.

Card-on-file payments require a valid credit or debit card configured to make online purchases – no surprise here. But, paradoxically, that’s where most problems stem from.

Reasons behind declined card transactions

There are several requirements the customer’s card has to fulfill to enable the merchant charging subscription fees successfully (it refers both to the initial transaction starting the plan and further recurring payments). If they’re not met, it gets declined and the transaction cannot be finalized in the given attempt. It is a situation to avoid because, as I will comment further, declined transactions generate financial losses due to unsuccessful collection of subscription fees and commission typically collected from each, even unsuccessful, transaction.

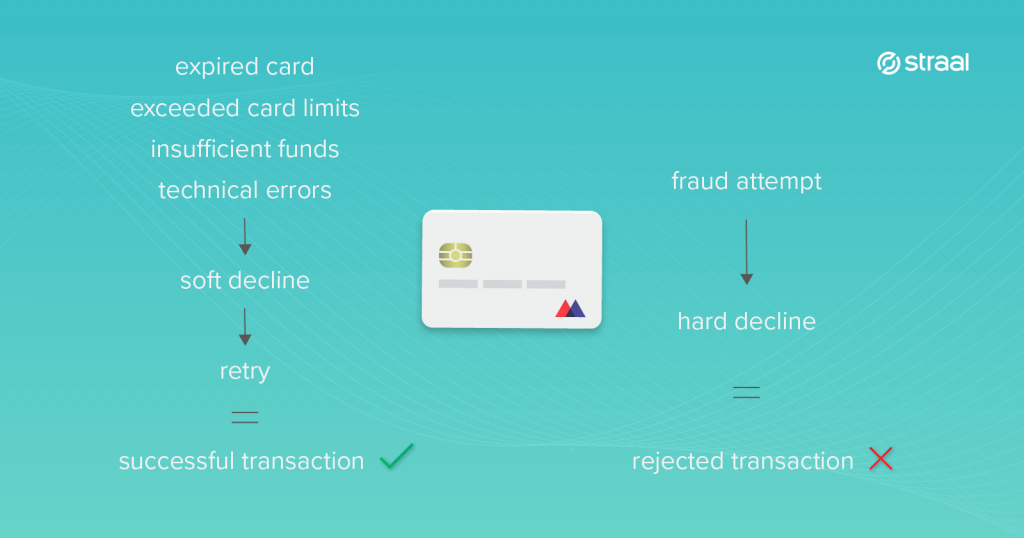

Selected payment gateways (such as the one provided by Straal) are configured to return information about an unauthorized transaction along with a decline reason code when the online card transaction is declined. These explain what kind of problem has appeared. There are plenty of reasons for this, yet, in the case of recurring payments, they typically come down to:

- insufficient funds: this problem occurs when the resources on your customer’s account associated with a given card are too few to fully cover the subscription fee;

- exceeded card limits: if your customer’s card is set to a limited number or quote of online transactions a day, it can get rejected when the limit is exceeded;

- expired card: according to Finextra, even 3% of cards expire each month worldwide; unfortunately, customers typically forget to introduce their new card data in your system and realize it only once you inform them that their subscription fee cannot be charged;

- technical errors: sometimes transactions get declined without the subscriber’s fault when technical errors occur at the PSP’s or card scheme’s side;

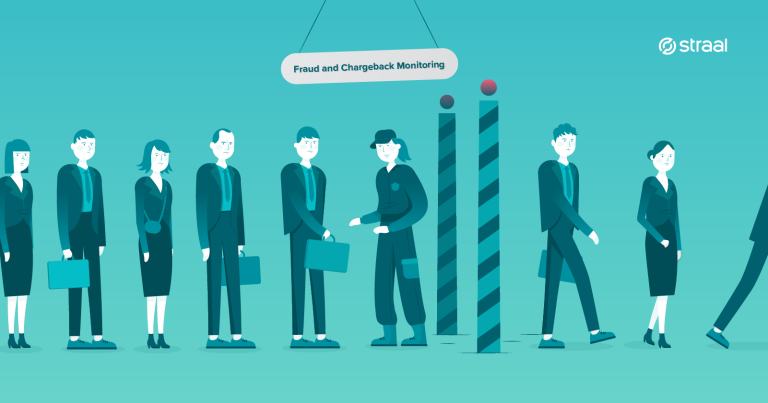

- suspected fraud: when the issuing bank’s, card scheme’s or PSP’s anti-fraud algorithms detect a suspicious transaction and mark it as fraudulent, it cannot be finalized as well and as online fraud is a rapidly increasing problem (Idology reports a 58% growth in 2018), those algorithms recognize ever more frauds.

When fraud is suspected by a PSP, the outcome is a hard decline which means that the transaction cannot be retried by this PSP (the merchant would have to contract another one) but if it’s the issuing bank or the card scheme that suspects it – it cannot be retried at all. However, the remaining reasons – expired card, exceeded limits, and insufficient funds – belong to the category of soft declines and in any of these cases transactions can, and of course should, be retried. Nonetheless, oftentimes, neither the first nor the second charging attempt proves successful. In such situations, merchants collect money only after several retries, which is undesired for several reasons explained further.

Declined card transactions: why care?

Although it may not seem obvious, ineffective card charging affects your company’s finances directly.

- First of all, when you fail to charge your subscribers, you don’t collect money from them, which basically means that you don’t generate a certain amount of revenue included in your financial forecast. It hampers your financial liquidity and introduces unpredictability into your operations based on financial planning.

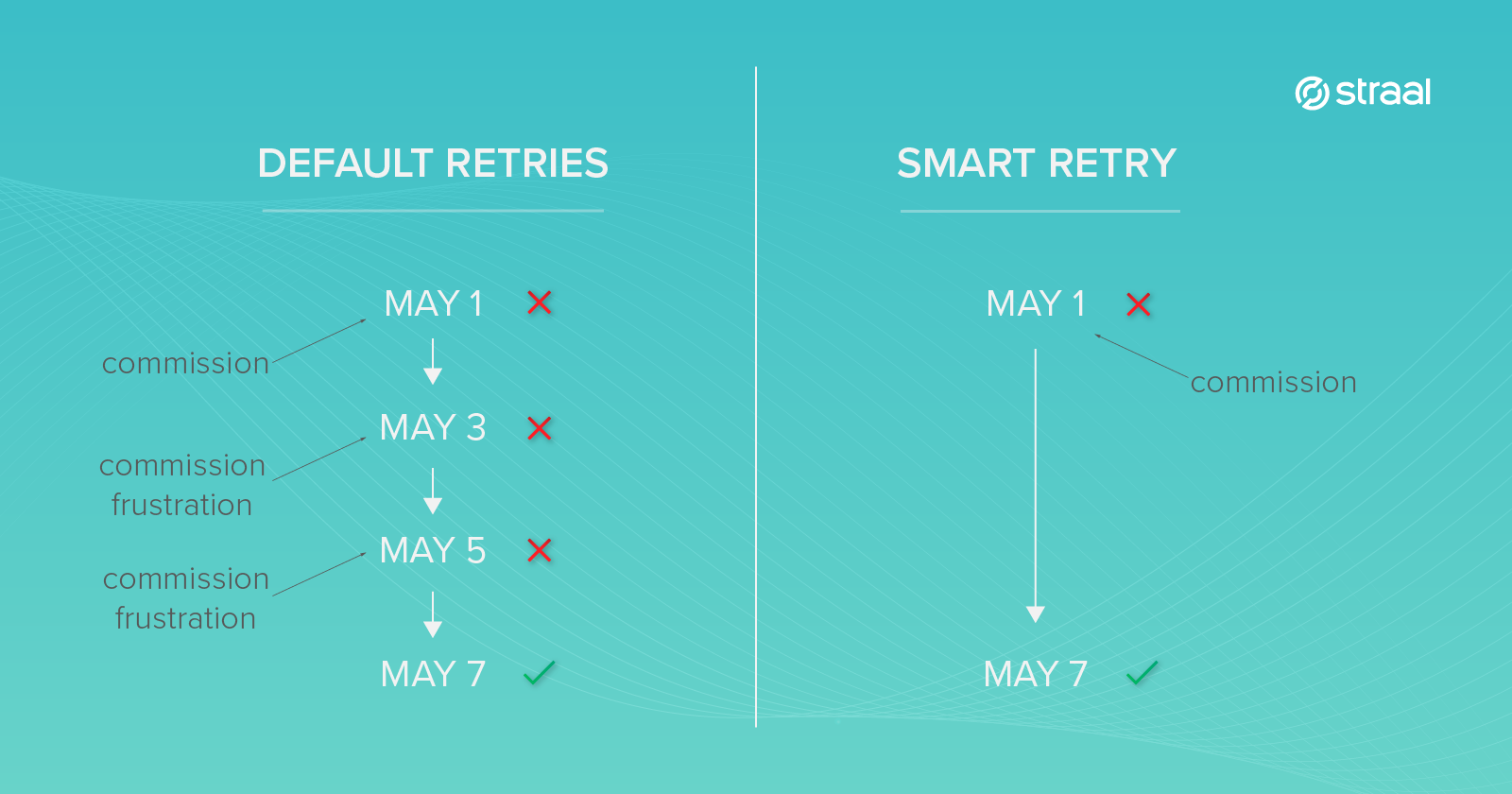

- What’s more, PSPs typically collect commission from every transaction they enable for your company, even when those end up declined. In other words, the more attempts needed to successfully charge a card, the higher your operational cost and the lower your CLTV (Customer Lifetime Value) indicator.

- Additionally, transactions that have been declined several times may end up blocked due to a suspected fraud attempt. As a result, again, you don’t generate revenue from a given subscriber. The number of allowed retries is set by card organizations’ anti-fraud algorithms so, in order to comply with the rules of all card schemes, it is advisable to reduce the number of retries to the absolute minimum.

- Last but not least, ineffective charging affects your customers’ convenience. Decline reason codes provoke frustration in subscribers and – believe me – they won’t investigate whether it has occurred on the side of your company, your PSP, acquirer or issuer (read about the roles involved in the payment ecosystem here). When it comes to customers’ comfort, there are seldom second chances: National Business Research Institute claims that there is even an 88% chance that a customer having negative experience will switch to one of your competitors.

Although in the first situation the number of retries doesn’t make so much difference, in the remaining ones it, indeed, does. Simple retries continue until a successful charging is executed which results in a double loss: of your resources due to commission collecting and your customers’ satisfaction. To avoid them, it’s absolutely necessary to retry declined transactions in sequences that take into account historical data of a given subscriber’s transactions (e.g. overall transaction success rate, dates of declined payments, acquirers linked with successful and unsuccessful transactions).

What is Smart Retry?

Smart Retry is an optimization tool aiming to increase the effectiveness of charging subscription fees from credit and debit cards after the first attempt proves unsuccessful. As mentioned above, you may apply it when dealing with a soft decline. According to Straal’s statistics, 100% of merchants making use of this tools increase the number of successful transactions. What’s more, they finalize approx. 20% more transactions (counting both the initial and Smart-Retry-driven ones) compared to those not applying Smart Retry. How does it work, then?

When you decide to collect subscription payments with the use of automated card charging, you need to inform your PSP about how these payments will be collected. In other words, you provide your PSP with a customized set of rules they will follow while collecting money from your subscribers. These rules define, among others, your subscription charging schedule, i.e. on what day of the cycle your customers’ cards will be charged (you can read more about it in Straal’s documentation).

However, as stated before, subscription charging is not always successful and to solve the problem, you might request your PSP to retry collecting payments after a predefined number of days. Sometimes it’s enough, yet there are cases when the transaction is rejected again, e.g. due to insufficient funds on the payer’s account (which is quite common: subscribers coming from diverse countries receive salary on different dates so applying the same set of rules to all of them may generate problems). It means that if you set the charging schedule to, for instance, the first day of the month, some of your clients may not have sufficient funds on their account yet. In such cases, it’s advisable to retry charging once the money has already been wired from their employers to their bank accounts.

Here comes Smart Retry. Most retry solutions depend exclusively on the general charging schedule applying to all customer segments provided to your PSP. In Smart Retry, by contrast, the retry schedule is adjusted to the specific requirements defined by your industry, vertical, target markets, customer segments and so on, building on historical data gathered by your PSP over time. Retry policies take into account factors such as: card brand, acquirers matched with the subscriber, retry days or retries number. The financial patterns of your subscribers are leveraged to perform retries when the chances for transaction approval are the highest – the outcome being a reduced number of unsuccessful retries, lower cost of processing, higher revenue predictability and, thus, financial stability of your company.

When you apply Smart Retry, the system retries charging subscriber X’s card once he can have sufficient funds to cover his subscription fee, e.g. only on the 10th day of the month (as in Poland, where a number of employees receive salary on that day). How does your PSP know about it? It’s simple – the historical data of subscriber X’s card charging shows that on most occasions, the fee is collected from his card only in the 3rd retry performed on the 10th day. With Smart Retry, the number of attempts is reduced to just two of them which saves your money and provides better experience for your client. A win-win situation!

Major benefits of applying Smart Retry

Unsuccessful subscription fee charging results in financial loss as well as subscriber’s frustration. Making use of Smart Retry brings measurable, tangible benefits such as:

- higher revenue generated thanks to successful collection of subscription fees,

- reduction of costs generated by commissions charged by your PSP for enabling unsuccessful transactions,

- more accurate financial planning resulting from collecting payments successfully in predefined, or at least predictable, cycles,

- reduction of operational time and costs generated by customer support specialists (e.g. when forced to contact subscribers directly when transactions cannot be finalized),

- enhanced user satisfaction thanks to minimizing the number of ineffective retries.

Final thoughts on Smart Retry

As payment technology is rapidly developing, collecting money from customers shouldn’t hinder everyday business activities any more. Merchants, especially those operating on the subscription market, should search for payment solutions optimized for their business models (if you’re at the stage of looking for a subscription-friendly payment gateway, read Michał Jędraszak’s entry to learn what features to look for). Straal’s Smart Retry is a perfect answer to the challenges subscription merchants are facing. Contact our Sales Team to learn how to implement it in your business and enjoy all profits listed in this entry!