Customer retention is paramount for companies operating in the subscription-based model. Having said that, one should learn how to measure it and make the most of the statistics at hand. What subscription metrics to track? And how to convert them into actionable insights? Find out from this brief entry.

Customer retention – key to the subscription success

The subscription model is based on two core types of billing (and countless hybrid combinations based on the two):

- “fixed fee” where the client is charged a predefined amount every week/month/year, regardless of the usage of the service,

- “pay-as-you-go” where the amount varies depending on defined factors.

Adopting the subscription model is very much like running a user club: the goal is to satisfy the “club members” as their satisfaction determines if and for how long they stay with you, if they’ll pay the “membership fee” regularly, and if they’re going to purchase more services and “recruit new members”.

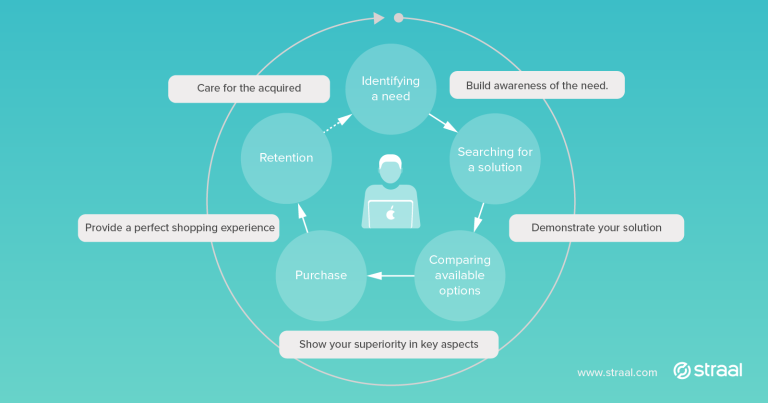

Stability and predictability of revenue resulting from effective customer retention are key competitive advantages of the subscription business model. Yet, it doesn’t mean that the actions taken during the first stages of the customer lifecycle are meaningless. On the contrary – acquiring new clients is a crucial task but it doesn’t mean that retention should be considerably lower on the priority list. All in all, these are the existing clients who pay subscription fees regularly.

Subscription metrics to follow

In order to retain customers effectively, it is necessary to monitor the dynamics of processes that contribute to your overall business performance and financial condition. There are several retention metrics used in any subscription business. Besides the traditional ratios such as CR (Conversion Rate), CAC (Customer Acquisition Rate) or the whole range of variables connected with marketing effectiveness and functioning of particular sales channels, one needs to track:

- MRR (Monthly Recurring Revenue) – the sum of all recurring revenues generated by subscription payments from your clients in a given month (excluding one-off fees). Monitoring MRR enables you to assess whether your subscription business is developing or not. It’s worth observing a range of variables accounting for MRR that illustrate and explain the dynamics: New MRR – the value of recurring revenue generated by new subscribers (acquired in a given month); Expansion MRR – recurring revenue generated by existing clients who have upgraded their pricing plan in the analysed period; Churned MRR – recurring revenue lost due to the termination of the customers’ subscriptions – be it voluntary or involuntary; Net MRR – the value of all recurring revenues generated in a given month less the value of all recurring revenue lost in this period.

- Churn Rate – the percentage of subscribers that have stopped being subscribers in the analysed period. To calculate it, one has to divide the number of subscribers that have left in the given period by the sum of subscribers at the beginning of the period and new subscribers acquired in this time. A “healthy” Churn Rate varies depending on the industry and the company’s development stage. There are no rigid rules here – the only one is “the lower, the better”. It is key to identify two groups of customers: the ones that have left willingly (Voluntary Churn) and those that whose subscription got cancelled unwillingly (Involuntary Churn Rate) (e.g. forgot to secure funds on their credit card).

- LTV (Lifetime Value) – the average estimated revenue generated by a unique subscriber during their lifetime. Sources suggest several ways of calculating it but in the subscription model, LTV is the Average Monthly Revenue divided by the Monthly Churn Rate.

- ARPC (Average Revenue Per Customer) – the average revenue generated by a unique client during a given period of time; the total monthly revenue divided by the number of the subscribers that contributed to generating this revenue.

- CAC (Customer Acquisition Cost) Payback Time – the time needed to regain the cost of acquiring a unique subscriber typically expressed in days or months. To calculate it, divide the Customer Acquisition Cost by the Monthly Recurring Revenue less the cost of your service. The longer the CAC Payback Time is, the more capital and the bigger “financial pillow” is needed at the start.

How can one use these subscription metrics for effective customer retention (e.g. reduce Churn Rate)? First of all, you need to confront those with the ratios characterizing your users and look for correlations. You can e.g. measure Expansion MRR in various client segments, compare New MRR month by month dividing it into sales channels or calculate LTV and MRR for particular subscription plans. It is also crucial and very helpful to monitor the LTV/CAC ratio as this metric says if your spendings on acquiring new clients are optimized. For instance, a 1:1 ratio means that increasing marketing spendings will be a waste of money: the acquired clients will not let you regain the cost of acquiring them and so will not start generating profits. A 3:1 to 4:1 ratio is considered optimal. A 5:1 and higher means that you probably don’t invest enough in acquiring new clients and you are not using your full growth potential. The optimal proportions will let you invest in retention actions as well as up-selling and cross-selling.

Several retention clues to remember

So here comes the practice. When running a subscription business, remember about several things:

- Early at the purchase stage, make sure your subscribers understand that they purchase a subscription service and will have to pay for it in a recurrent way. Unclear communication often leads to clients’ dissatisfaction, increasing the Churn Rate.

- Keep reducing the Involuntary Churn Rate until it reaches the absolute minimum. If your subscribers leave due to payment failures, apply solutions aimed at maximizing revenue collection. Start from facilitating the communication (remind your clients about the upcoming payment), choose the best moment to charge cards, and – if needed – automatically collect payments in more than one transaction over a certain period (it’s enabled by high-class subscription payment management systems).

- Keep monitoring your subscribers’ behavior as the way they use your service changes over time. Based on that, you can create both a high-quality supporting content and an additional up- and cross-selling offering. For example, if you sell software and observe a tendency to upgrade into a higher plan after 6 months, you can inform your customers about the upgrade in advance and offer a special price (up-selling) before they even start to hesitate between upgrading your product and finding a new provider. You can also suggest paid extras – useful for a given client segment – in the form of subscriptions or one-off purchases (cross-selling).

- Seek to maintain low Contraction Rate (the percentage of users switching to a lower subscription plan). It is possible – just like cross-selling – thanks to monitoring customers’ behavior and the way they use your product/service. The increase of the Contraction Rate is a good sign only when accompanied by reduced Churn Rate. Then, it shows effective, proactive retention actions. In any other case, it should be considered a warning signal saying that your subscribers are dissatisfied with some of the aspects of the “club” membership.

Retention monitoring for higher effectiveness

The monitoring of the mentioned subscription metrics should be conducted on a regular basis. Learning which metrics to use and how to measure them increases the effectiveness of retention actions significantly and, in a wider perspective, supports your strategic business planning. Thanks to that, your online business becomes more profitable.