Once you have gone through dozens of websites explaining how to open an e-store, terms such as KYC or merchant onboarding may ring a bell with you. You will deal with them before jump-starting your online business, so understanding what they mean in advance is going to save you much time. What is KYC in the context of online payments and how does it relate to the merchant onboarding procedure?

What Does KYC Stand for?

KYC is an acronym for Know Your Customer (alternatively Know Your Client) but the long version is seldom used. It’s a process during which a business entity verifies the identity of its potential client (be it an individual or a company). This procedure is used across industries but the acronym is mentioned most often in the context of finance and banking.

You may be subject to a KYC procedure when:

- you want to start using an e-wallet,

- you wish to open a bank account for your company,

- you plan to integrate your website with a payment gateway.

The overall aim of KYC processes and policies is to prevent organizations from getting involved in risky deals that may result in financial or reputational damage . By Know Your Customer procedures, they check whether their potential clients are who they claim to be and if doing business with them will not pose a risk to any party involved. At the end of the day, KYC is meant to protect business entities against money laundering or helping to finance terrorism or organized crime.

KYC and Online Payments: the Why and the How

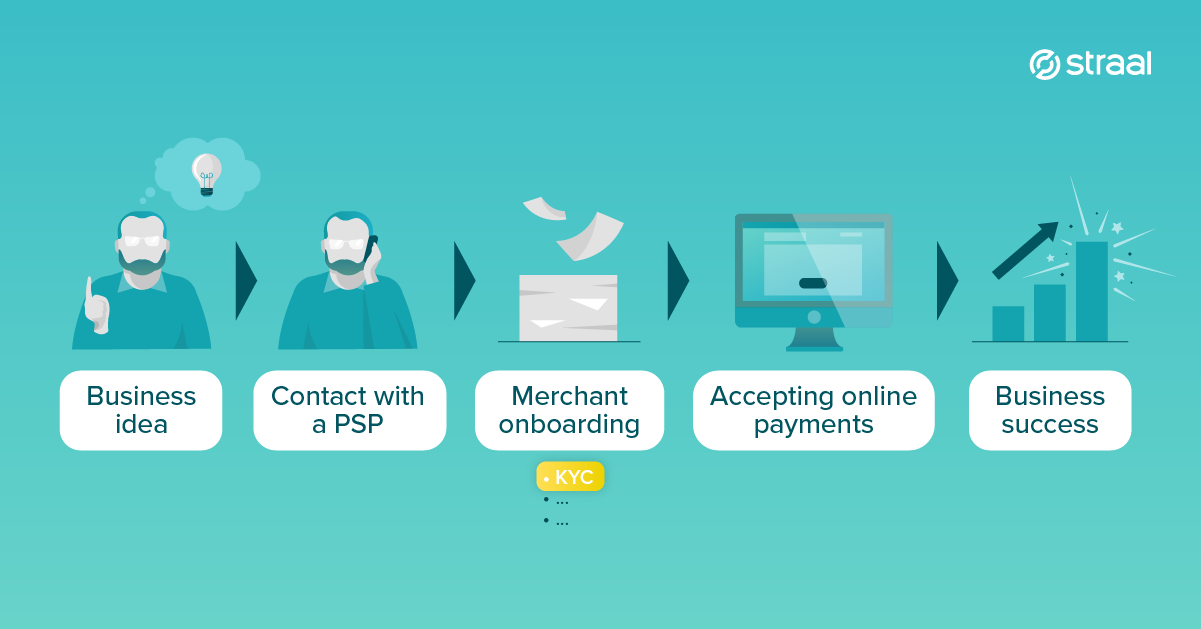

In order to open an online store or any other business requiring accepting online payments, merchants have to contract a PSP (Payment Service Provider). Nonetheless, finding one doesn’t guarantee a deal being sealed; as acquirers and payment facilitators deliver financial services, they have to make sure that their potential clients run legal businesses and will not harm any party’s financial conditions or reputation. This is the reason behind including KYC in merchant onboarding procedures. If KYC findings suggest possible future payment fraud, the PSP will reject the client and not deliver its services to this company.

Merchant onboarding is, simply put, a process whose central part is setting up a merchant account (be it a proper account or a sub-account maintained by a payment facilitator). As mentioned before, KYC is one of the elements of this procedure and if a potential PSP’s client doesn’t undergo it successfully, merchant onboarding cannot be completed.

How much time a merchant needs to undergo a KYC process depends on the given acquirer’s or payment facilitator’s KYC and risk/compliance management policies. These are created internally and can differ from one payment company to another. Surely, merchant’s engagement also plays a role: while undergoing the Know Your Customer procedure, they will be asked to provide specific documents certifying their identity (ownership, source of funds, past processing history, financial health, etc.), so the quicker they do it, the shorter the onboarding procedure.

KYC: What is Verified by the PSP

As I have mentioned before, KYC requirements are imposed by payment companies’ individual policies, but they have several common denominators. During the KYC process, your PSP is likely to verify:

- company and beneficiary documents i.e. documentation such as the excerpt from your national court register, company agreements, the shareholder register, the statement on the actual beneficiary (or the ‘Ultimate Beneficial Owner’), certified proofs of identity of real beneficiaries and directors (scans of passports or IDs, address proofs, the ownership structure document, etc. (you’ll be asked to deliver those that apply to your company’s legal form); your PSP will also use them to check basic company information such as its full name, registration address, etc.;

- required business licenses if you operate in a licensed industry, e.g. provide financial services, sell alcoholic beverages or run a gambling business;

- company bank account details, to be precise: information about the bank account to which funds from the transactions processed by the PSP will be transferred (is the receiver account in the same name as the company’s legal name);

- distribution agreements if you maintain supplier-distributor relationships;

- terms and conditions of your online point of sale (you may be also asked to deliver sample contracts signed by your clients);

- business plan if your company is a startup and has no commercial history.

As a part of its KYC procedure, your future PSP may also check whether your website is prepared for accepting online payments in a legal way. To cut a long story short, the payment service provider will try to act as your potential client to see if the whole shopping process is clear and leaves no doubt as to what is purchased and how. In this context, customer orientation and transparency are paramount. And keep in mind that if you are processing payments via credit cards, card schemes have specific rules relating to card not present (or CNP) procedures.

How to Get Through a Know Your Customer Procedure Smoothly

When you finally know why payment companies make you undergo a KYC process and what it is about, you may be asking yourself how to prepare for it. It’s very simple and as long as you run a fully legal business complying with all applicable regulations, you shouldn’t face any problems. It’s also worth showing your potential PSP that your business is well designed and profitable. Keep in mind that the length of this process depends heavily on how quick you gather all the necessary documentation. After collecting all documents, you should undergo the process rather smoothly.

1. Make your business plan clear and informative

If you’re a startup, your potential PSP will ask you for your business plan to see if what you’re offering is legal and if it seems profitable. You probably already have one, but make sure that the document answers all questions and doesn’t make your future business seem shady or failing to consider mid-term challenges. Keep in mind that skipping some sections (for any reason you may have) will generate follow-up questions. Don’t take things for granted and try to describe everything as clearly as possible. Remember that PSPs are not experts in your industry, so they may not be aware of certain things.

2. Present your company in a transparent way

No matter if your company is a bunch of business newbies or a group of experienced executives, you’ll have to prove that it operates along with your industry regulations. Presenting a clear company structure and all documentation connected with its legal form is crucial in this context. The simpler the internal and external connections of your company, the shorter the KYC process will be. And, once again, remember: hiding facts, whatever the reason, will make you seem shady. Also, mind that if your company is registered in a tax haven, undergoing the KYC process may be more difficult (nevertheless, if it’s an EU country such as Malta or Cyprus, keeping in mind the transparency rule, you are likely to succeed).

3. Receive all necessary licenses in advance

As I’ve stated before, during the KYC procedure your potential PSP will require you to present all necessary business licenses. Even if you’re a startup, claiming that you don’t have them yet but will receive them soon won’t be enough. Make sure that every document required in your industry is already at your disposal.

4. Prepare your website for accepting online payments

After reviewing your company documentation, the payment service provider will check whether your website’s design makes it legal (and reliable) to accept online payments. As this topic is slightly more complex, we’ve covered it in a separate entry.

Prepare for KYC and Start Selling Online Soon!

If you follow our simple guide and prepare for the Know Your Customer procedure in advance, you’ll get through merchant onboarding quickly and start selling online soon! Keep in mind that KYC is meant to protect payment companies from fraudsters and not make your professional life and company’s success harder.

At Straal, KYC procedures are directed by experts in this field to make your merchant onboarding maximally short and frictionless. If you want to know what documents are required in this process and what else counts during merchant onboarding, drop us a line at [email protected]. Our KYC specialists will contact you as soon as possible and your doubts will be dispelled!