Every business needs to keep up the pace to survive. If you are a small and a medium business owner (SME) you need to face many complexities in running and growing your businesses. Since cash is no longer king, business owners now have many opportunities to digitize their payment processes that will be beneficial and convenient for buyers and sellers. The tech revolution made modern payment capabilities accessible to micro and small businesses. But there are so many payment methods to choose from: which one is the right one for you that will address the specific needs of your business? How to implement it?

According to Square’s report, 60% of shoppers will spend more if a brand accepts cards. Moreover, 25% of online buyers decide not to purchase a product when card payments are unavailable. We, at Straal, believe that understanding the significant value that can be unlocked for SMEs by accepting card-based payments, finding it strategically important, so it improves payment flow, lowers cart abandonment rates and last but not least, drives efficiency – crucial for SMEs (more on this matter later).

Why do consumers choose card payments?

We live in times where every second of customers’ time is priceless. They want to pick and purchase a product within a blink of an eye. Therefore, a transaction process should be seamless. Because of a great user experience, you will receive a loyal and satisfied customer.

Why are card payments one of the most popular payment methods amongst customers?

- Quick and popular

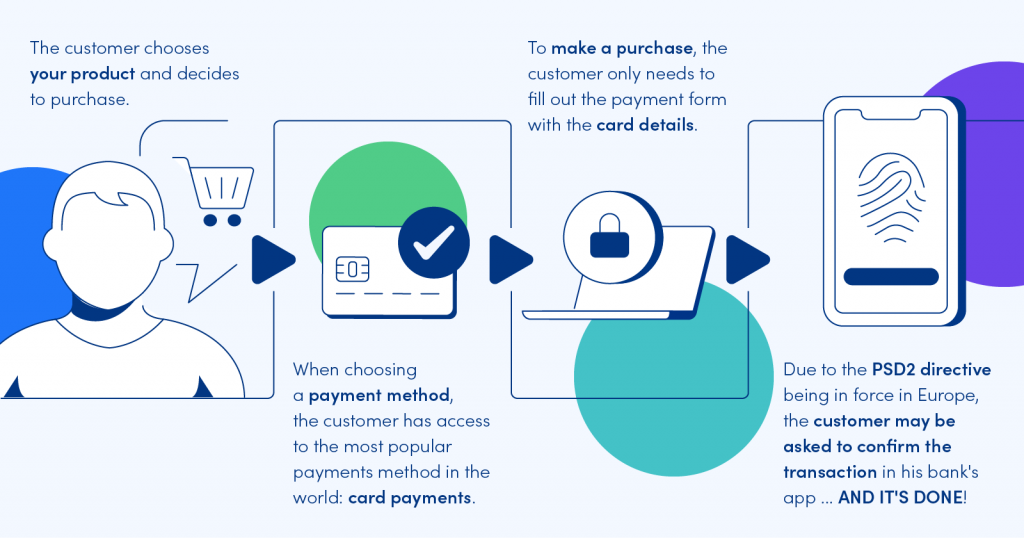

To make a purchase, the customer only needs to fill out the payment form with the card details – no matter where your buyer is located and which currency is used because card payments are available everywhere.

- Safe and secure for the buyers

When speaking of card payments, one concern that shows up is data safety – it’s understandable given that your customers share personal information and card details. Fortunately, card payments are a 100% safe and secure payment method. If a merchant uses providers such as a payment gateway, like Straal, the customer need not worry about the security of their sensitive data.

„In most developed markets, card payments are the leading form of payment. They bring great value to consumers and merchants alike through well-established mechanisms that make payment, settlement and balance checks convenient. With all the security measures available today, it’s often the payment method of choice for any kind of online purchases.”

Bartek van de Pavert, VP of Sales at Straal

- Contactless

Card payments require no physical contact, which poses a great advantage due to the outbreak of the Covid-19 pandemic. That is why it is a quick and convenient payment method and a secure solution considering 'newly introduced’ sanitary standards.

Easy payment flow with the card payments

The customer needs only to choose a product and pick card payments as the preferable payment method. Then, he fills out the form with the card details (which can be later stored in the system) and confirms the transaction. It is so easy, isn’t it?

Benefits of accepting card payments

One of the key benefits of implementing card payments to your payment methods, is that it simplifies both the sales process and your customers’ journey. What significantly affects and increases conversion rate and customer experience.

Check the others below:

- Sales boost

Card payments are a quick and easy way to purchase by the customer. Studies have shown that people are eager to spend more money if the transaction is quick: they’re often more open to paying extra if they don’t see how the coins flew away from their wallets.

- Analyze customers habits and spendings

The next benefit relates to the data and analysis – the key factor in the modern e-commerce world. The data available from a card processor can significantly help businesses identify their customers’ specific types of spending behaviour. The gathered insights may lead you to the discovery of new spending patterns that will open the doors to new target groups, thus enabling you to customize e.g., upselling strategies.

- Reduced risk, boosted cash-flow

Accepting card payments not only simplifies stock control but saves time usually spent on bookkeeping. Simply because, in that case, it’s done automatically. Card payments also reduce the risk of in-business theft as the records are generated for you with absolutely no need to count those heavy pouches filled with slippery coins! Card payments are also a better way to boost cash flow, especially compared to issuing invoices.

- Cardholders’ data protection

Second, if you partner up with a payment gateway like Straal, there is no need for a merchant to bother with compliance with the PCI DSS certificate – a set of security standards to protect cardholders’ data.

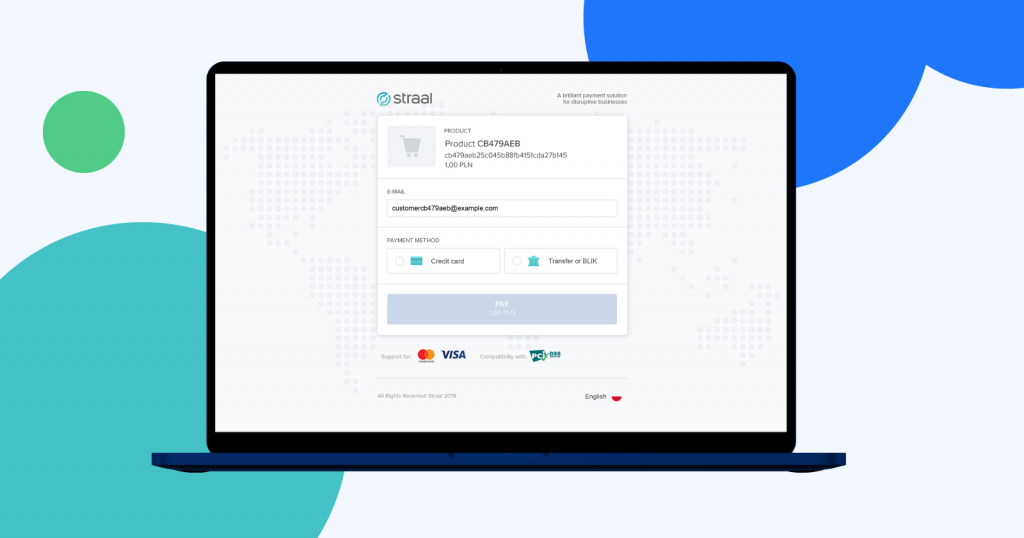

Other Card Payments Benefits: a Hosted Checkout Page

A checkout page is the final and most important stage of customers’ journey to buy your product or solutions. Fortunately, if you partner up with a payment gateway like Straal, you don’t have to worry about designing it from scratch, coding and hosting.

We offer a hosted checkout page optimised by our engineers that boosts conversion with these optimisers:

- fully intuitive

- customer friendly design

- ’security guaranteed’ logos attached

While the purpose is to simplify merchant integration, the increased conversion rate is the result. 100% of our merchants use this solution.

Check how a hosted checkout page looks below:

How to implement card payments to your business?

Good news: card payments are simpler and more cost-effective to set up than ever before. Would you like to get more information about running card payments with Straal? Feel free to reach out to us! Just click here.