Fintech insiders oftentimes erroneously assume that consumers, let alone merchants, know much more about the payment ecosystem than they actually do. This might lead to disturbing misunderstandings, make companies miss business opportunities, consumers get a headache and vendors fritter away their marketing budgets. It’s quite a paradox as online payments should and can support both business and consumers by making e-shopping easier, more convenient, and profitable. Indeed, payment value chain might, at first glance, seem a bit complicated and the omnipresent jargon definitely does not help to efface this impression. However, once you get a solid grasp of the matter, you soon realize how the right choice of tools and providers can bring you a handful of benefits.

As this is my very first entry here, I am going to start from the basics – the 5 must-know things about the payment ecosystem. The goal is to make it as clear and understandable as possible. If you are an online merchant or work for one, I want to help you understand the importance of certain payment features for your commercial success. If you are a consumer, I hope it will make you more aware and – as a result – safer and more comfortable while shopping online.

So, let’s hit the road!

1. Payment methods available in the ecosystem: distinguish must-haves from nice-to-haves

Describing all the payment methods available in the world would be hard, time-consuming and… not really useful. In the fintech era, each local market has at least one “alternative” payment method. “Alternative” to what? Below are described the 4 common types.

Credit/debit cards and card-based methods

Credit/debit card is the most popular online payment method in the world, preferred by 42%/28% of consumers. This stems from its popularity in the non-digital world. Credit cards are connected to credit accounts while debit cards with regular bank accounts.

Using a credit/debit card to carry out online transactions usually requires providing its number and other details in checkout payment forms on merchants’ websites or in their mobile apps. Typing a 16-digit number each time one wants to pay might be quite annoying and thus harmful for conversion. Therefore, more and more companies offer Card on File/One-click payments (i.e. Straal) and digital card-based wallets (i.e. MasterPass, Visa Checkout, ApplePay).

Both types by principal allow the cardholder to provide their payment details just once and securely save them for future use. Accepting cards is definitely a must for any online merchant these days.

Bank-transfer-based methods

Traditional bank transfers are executed within special inter-bank systems, be those local (e.g. iDeal), regional (e.g. SEPA) or global (e.g. SWIFT). Bank transfers often happen to be expensive and slow (especially when interregional).

In order to facilitate the payment procedure for consumers and to allow merchants to receive real-time transaction confirmation, in some countries payment service providers (PSPs) offer, so called, pay-by-links.

Pay-by-link is as simple as convenient. It involves a PSP having accounts in all popular banks operating in a given geography. The payer transfers the money to the PSP’s account in their bank, so the transfer is internal (conducted within the bank’s infrastructure) and instant. In effect, the PSP can provide the payee with an immediate transaction confirmation. The PSP then transfers the appropriate amount of money to the payee’s account.

When it comes to recurring bank transfers, though these are not instant, the payment process can be fully automated through the use of the Direct Debit mechanism – a model in which the payer entitles the payee to charge their account an agreed number of times.

As Direct Debit is a pull-based method, it’s the payee who initiates the transaction.

Not literally, of course.

Their bank does so on the basis of the payer’s permission. Direct Debit is a must on some markets – especially in the Eurozone, where SEPA Direct Debit is a popular consumer bill payment method. Pay-by-links, in turn, are a must-have for merchants targeting Poland – one of the largest EU-members – where most e-shoppers choose this method for their one-off transactions.

E-money transfers

This payment method requires preloading money to a special e-wallet (do not confuse with card-based e-wallets). The payment clears entirely in a closed-loop infrastructure and is instant. Unfortunately, it requires both: payer and payee to use the same transfer system, say, PayPal or Revolut. This payment method is usually more expensive than cards.

Accepting e-money transfers is a good option for cross-border merchants targeting specific groups of consumers who require instant fulfillment of their orders (digital goods!) and are used to topping-up their e-wallets instead of paying directly by card or via a bank transfer.

E-money transfers became popular in cross-border e-commerce due to limited operational capabilities of cards issued in the early 2000s. Today, however, most credit/debit cards can be used online without any restrictions. In other words, in most verticals e-money transfer is a nice-to-have payment method, not to be offered instead but besides card payments.

Cryptocurrencies

I’m sure you have heard about Bitcoin. But have you ever heard of Ethereum, Zcash, Dash, Ripple or Monero? Probably not. Cryptocurrencies are often described as the game-changing economic phenomenon. They make a complete new monetary system, which is global and independent of central banks (watch “Banking on Bitcoin” documentary, read Chris Skinner’s blog).

The units of cryptocurrencies (or sometimes just tiny pieces of such units) are stored in cryptocurrency wallets (just like traditional coins) and their value is regulated only by supply and demand. All that one needs to accept cryptocurrencies or pay in a cryptocurrency is a special wallet app to store it.

Unfortunately, cryptocurrencies are prone to fluctuation, “invisible” for most national regulators, and thus quite risky for business. Unless you operate in a kind of business targeting communities of cryptocurrencies’ enthusiasts, accepting this payment method probably won’t bring you many benefits.

As you can see, the right choice of payment methods is really important.

While accepting credit/debit cards is a must – as those are used by people all around the world – you should also take into account the needs of your local customers and the specifics of your business model.

If you run a subscription-based business, for instance, credit/debit cards (Card on File) and (if in Europe) SEPA Direct Debit should suffice your needs.

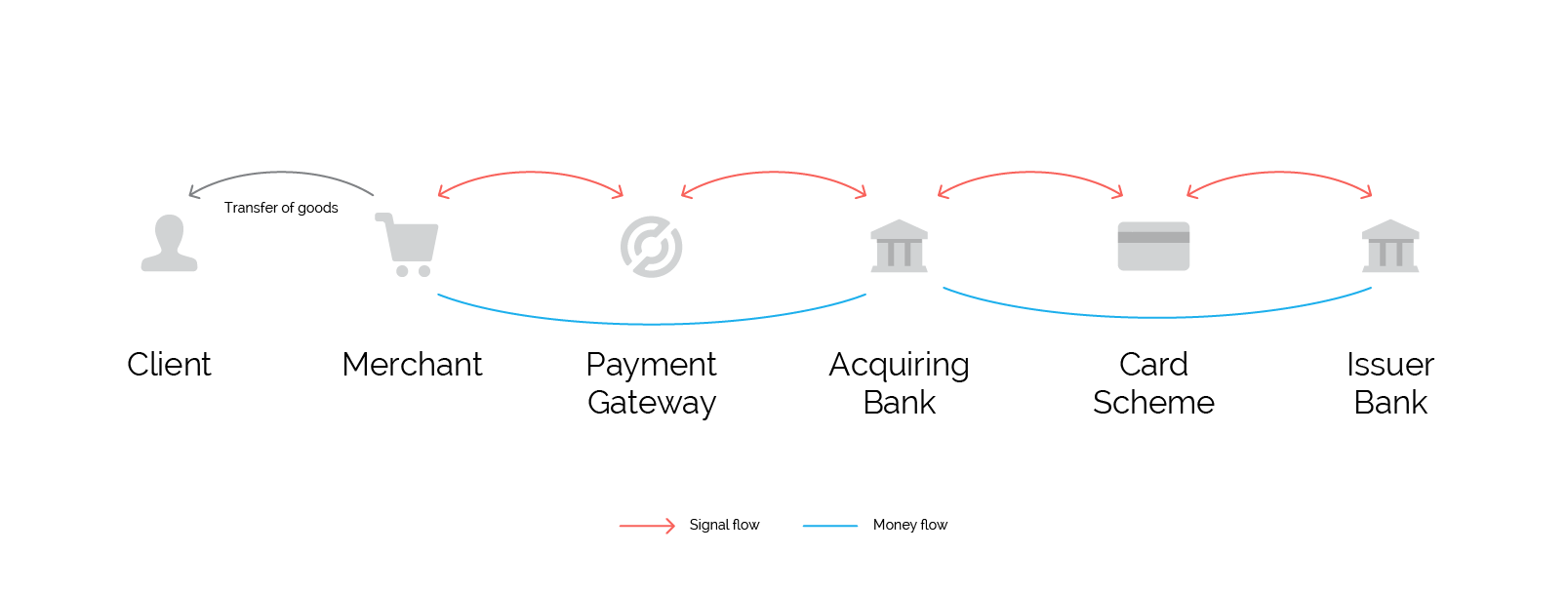

2. Parties involved in the payment value chain: know who is who and what their job is

As credit/debit cards are the most popular payment methods among consumers, and at the very same time the payment ecosystem they belong to is the most complex one, from now on, I’m going to focus on the card payment process.

Basically, there are four parties involved in each card transactions that customers carry out using their cards online. These are:

- Payment Gateway – the entity responsible for enabling accepting payments on the website or via an app. It usually offers several payment methods.

- Acquirer (or Acquiring Bank) – the entity responsible for processing the transaction. Acquirer exchanges information about the payer and the transaction with the card scheme to which the card used to carry out the payment belongs.

- Card Scheme (Card Organization) – it gathers card issuers and acquirers, and is responsible for executing, managing and policing everything transaction-related concerning cards issued under its brand. In practice, it’s a proxy between the acquirer and the issuer.

- Issuer (or Issuing Bank) –a bank that has issued the payer’s card under the brand of a card scheme.

3. Card transaction lifecycle: know what happens between clicking a “Pay” button and actual payment settlement

So, this is a regular online card transaction.

A customer proceeds to a checkout page. They type in their 16-digit card number, its expiration date, cardholder’s name and the security code (CSC). The entity that they are interacting with right now is a Payment Gateway. The checkout page is either provided by the gateway services provider or, at least the fields are encrypted by one.

There are 3 key transaction statuses that might help you understand where the money actually is at different stages of the payment process.

- Authorized – Once the payer provides their card details, the gateway sends those over to a PSP. The PSP communicates with a card scheme and the card scheme checks with the issuer if the card is valid and if there is enough money on the account. If the bank confirms that everything is fine, the transaction is given an Authorized status which puts a hold on the funds but does not remove money from the payer’s account.

- Captured – this status is given when the money is removed from the payer’s account, being processed by a PSP and a card scheme.

- Settled – the transaction is settled when the money hits the merchant account in the PSP’s system to be soon transferred to the payee’s bank account.

4. Currencies matter: remember you don’t need an account in Kyrgyzstanian Som to sell to customers from Kyrgyzstan

While talking about currencies in online payments, as seen from a merchant’s perspective, there are two important terms: transaction currency and settlement currency.

Transaction currency is the one displayed in an e-store/app. It means that when the displayed price is, say, EUR 100, no matter the currency of the payer’s card or account, they will be charged EUR 100. The FX rate and fees charged will be up to the card scheme and the issuing bank.

Settlement currency is the one in which the money from online sales is wired to the merchant bank account. If the settlement and transaction currencies are different, the FX rate and charges are in most cases decided by the acquirer.

Simply put, as a merchant you can allow customers to pay in any currency (transaction currency), but the money will be wired to your account in one of the settlement currencies offered by your PSP.

5. Payment fraud: bread and butter of the payment ecosystem that might be prevented

Fraud is an immanent part of everything money-related. Sad but true.

It affects merchants of any size and vertical. If your company hasn’t experienced it yet, you’ve been either extremely lucky or haven’t been around long enough.

While talking about fraud in the context of the payment ecosystem, you should, first of all, understand that it’s not a matter of “if” but “when” someone will try to extort your and your customers’ money.

To cut a long story short, as for online card payments plastic cards are not necessary (all one needs are card details), criminals buy breached card databases on the black market and use them to carry out transactions in online stores. They usually target digital goods merchants as they consider such businesses as sitting ducks. Digital goods are delivered instantly and are easy to resell.

Consumers are relatively well protected against fraud by car schemes. Once a legitimate cardholder realizes that their card has been illegitimately charged, they can always contact their bank and claim chargeback – a refund. For the merchant who had accepted a fraudulent transaction it means that they have to return the money.

In fact, they lose both – extorted goods and earned funds. You can learn more about payment fraud by following the blog run by our strategic partner – Nethone.

Fortunately, there are some really smart tools to protect merchants against fraud. Top-class anti-fraud solutions leverage Artificial Intelligence to predict fraud attempts before they even take place and issue real-time legitimacy assessment recommendations for merchants so they can drop a transaction instead of eating a humble pie when receiving the chargeback report.

Quality Payment Gateways offer fraud prevention as a part of the service. To use the must-have vs. nice-to-have dichotomy from the first part of this article – an effective anti-fraud solution on board is a must for online merchants regardless of their transaction volumes, vertical or anything else.

I hope that this article has given you a grasp of the payment ecosystem. Should you have any questions, please don’t hesitate to contact me through our press office. If you want to learn more about the broad portfolio of payment features offered by Straal, please get in touch with our team.