How do payment solutions chosen by your company influence your business performance? It’s important to decide on such that will not only meet your current requirements but also support your development strategy in the long term and smoothly scale your business.

1. Business model first, payment solutions second

First of all, you need to think of the business model adopted by your company. Think about the traditional “Marketing Mix” – it’s a good starting point. Even if you have your portfolio of products and services commercialized under many different models, the way you sell defines the way you get paid – and, hence, the way you let your customers carry out transactions.

Start by identifying the sales channels that you use to reach customers. Whether you own a brick-and-mortar point(s) of sale and intend to grow your online presence or your business is 100% online (without any physical customer-facing elements) will inevitably determine your payments strategy. Here’s why.

As long as you rely on just one channel, things are relatively easy. You sell goods/services and receive payments from customers via a merchant account hosted by your PSP (to get familiar with the slang, read the recent blog entry about the payment ecosystem). You probably have access to some kind of a merchant dashboard (or an API integrated with your CRM) with basic information about your stream of transactions and periodically receive some generic reports with transactional data. However, if you operate across more than one channel, you should search for a payment service provider capable of handling your payments wherever and however you decide to deliver your merchandise to the market.

Most traditional PSPs specialise either in brick-and-mortar commerce or in e-commerce. Implementing two or more payment solutions across two or more different channels equals at least twice as much paperwork and almost certain incompatibility of the systems. Sure, you can merge and process all the data manually, but in the long run it’s expensive, labour-intensive and, overall, counterproductive (feasible only as long as you are operating on tiny volumes). Search for a PSP capable of providing you with a full, 360 range of payment services across all possible sales channels, along with uniform analytical and reporting standards and tools, so you can look at your business holistically – to embrace the bigger picture as well as to spot the tiniest, most subtle nuances.

Consider the frequency of shopping. It is quite obvious that you would like your customers to return as often as possible, buy more and more, and recommend your products/services to their friends, families and even acquaintances. Is your merchandise of a kind that consumers purchase regularly or just occasionally?

If your services/products are more-or-less uniform and your merchandise is provided in certain cycles or just recurring intervals, you should consider adopting the subscription-based model. It comes with revenue predictability, enhanced product/service accessibility for consumers, and above-average customer loyalty. It is good – for businesses that maintain repetitive, relatively frequent interactions with customers (e.g. video/music streaming platforms, SaaS products, fitness clubs, etc.).

If you trade in something that consumers purchase from time to time – like high-end jewellery, art or premium class electronics, you should focus on friction-free shopping experience based on one-off transactions – to minimize shopping cart abandonment and ensure positive sentiment, so your customers will be more likely to return.

In both cases, card-on-file payment solution might bring significant value. In card-on-file mechanism, your customers save their credit card details in your or your PSPs system, so you can either charge the card whenever necessary (in accordance to their subscription plan or for the relevant service they used) or they can swiftly launch transactions with just one click like they do on Amazon.

Whichever option fits your business better, make sure the frequency of shopping is included in your analysis before you select your payment solution.

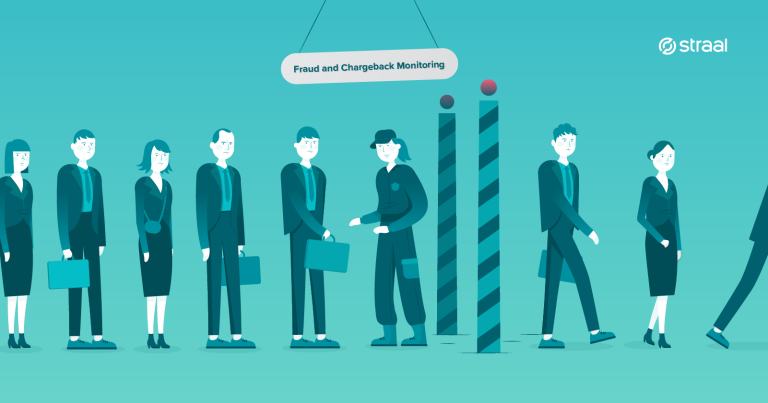

Last but not least, when analysing your business model in the context of payments, think of the volume vs value relation specific to your company in particular, as well as to your industry. If you count on frequent and numerous transactions carried out by hundreds of thousands of consumers, you need a robust, high-capacity solution capable of ensuring smooth processing of all your transactions, regardless of the number of payers carrying out payments at the very same time. If, however, you hope for a limited number of loyal customers who occasionally make big purchases, your payment solution should be very effective in preventing fraud (quality payment gateways offer this by default), UX-friendly and military-grade secure, so you don’t need to worry about chargeback thresholds. Remember that the pricing model proposed by your PSP should be adjusted to your company’s particularities and needs. A thorough analysis of many different pricing models is a book-size topic, yet I will try to deal with it in another blog post, so – stay tuned.

2. Get to know your customers

Online or offline, as a merchant, you must understand your customers to give them what they want, need, expect, and to predict what new needs and expectations you can potentially create and convince people to internalize. Getting to know your customers is crucial also in the context of payments. You need to know who your shoppers are, where they are, what their preferred payment methods and tools are, and so on.

Who are they?

I’m quite certain that you have already conducted your research and perhaps made a segmentation exercise too. You probably have created some, so called, personas. As quite conveniently defined by one of Hubspot’s bloggers: a buyer persona is a semi-fictional representation of your ideal customer based on market research and real data about your existing customers. While creating your personas, include everything you know and everything that is broadly known about their financial habits and preferences. Are you selling to Millennials, baby boomers, or maybe Z’s? This information will be extremely useful while selecting your payment solutions.

Where are they?

Do your customers live in one country or are they dispersed across many different geographies? The ability to sell goods and services to customers from all around the world is the main advantage of online commerce. If you plan to expand internationally, you probably know your next target geographies. It is not enough to have your storefront translated into multiple languages and equipped with adequate legal disclaimers. You need a PSP that understands the nature of your target markets. For example, in Latin America consumers like to make even tiny purchases using multiple credit cards. In Germany and France, consumers like to pay for their recurring purchases with SEPA Direct Debit, and so on and so forth.

What payment methods they prefer?

The former question naturally triggers the one about your customers’ preferred payment methods. Of course, credit and debit cards have dominated most markets and accepting those is a must for any online merchant. But there are many regional and local payment methods, sometimes very popular among consumers. In Poland, for instance,

e-shoppers prefer quick e-bank transfers (pay by link), while in Benelux they often use iDEAL (a local payment method quite similar to pay-by-link). While selecting your PSP, think about your expansion plans. Ask your potential providers about the availability of their services in your target geographies as well as about local payment methods they offer. In most EU countries, credit cards and SEPA Direct Debit should suffice, but remember to learn as much as possible about the consumer habits of your future target markets before you expand.

3. Embrace what’s beyond payments

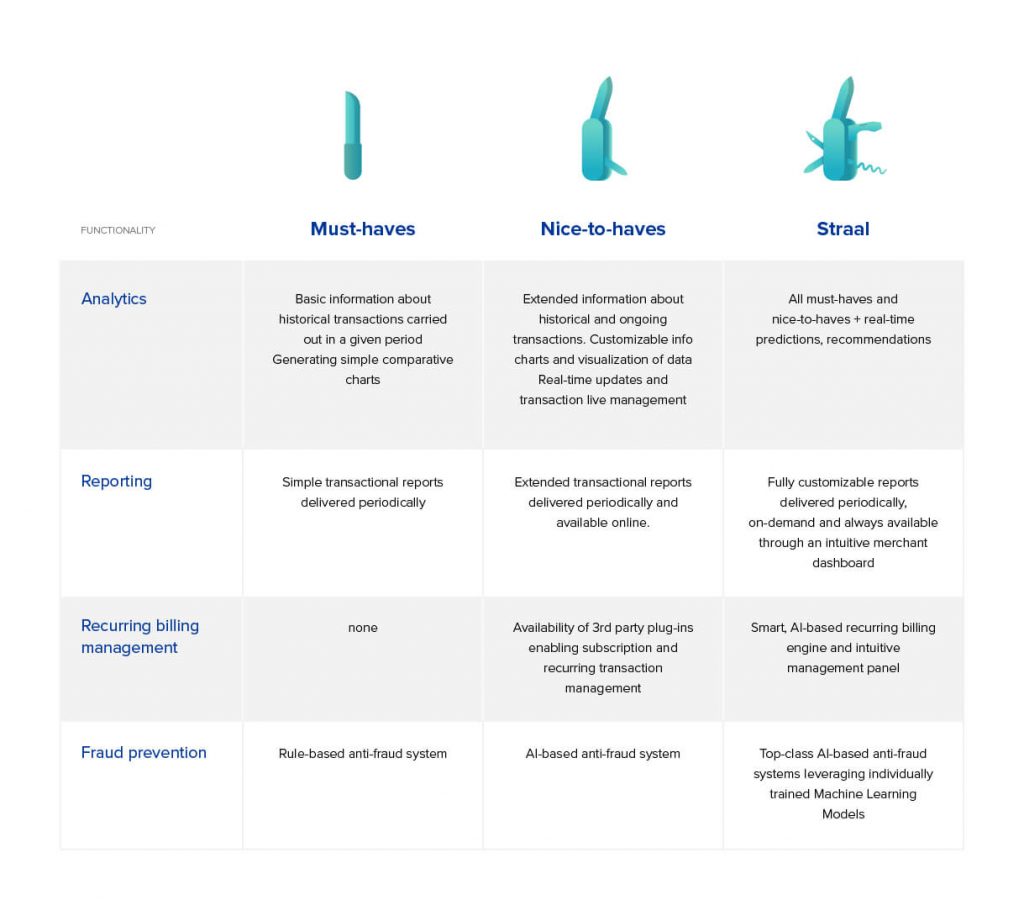

Today, payment solutions include much more than just a simple mechanism enabling transactions and collecting payments. Here are some key features that your PSP should provide along with the payment service. If they don’t, feel entitled to make a demand or switch to their competitors.

Should you have any questions, don’t hesitate to contact our team.