Whether you are a business owner, associate, or a consumer – chances are you have already subscribed to at least a few services that could have been as well purchased as standalone products. Music streaming rather than individual albums? Check. Web-based CRM rather than in-house, legacy software? Check. You get the idea. After all, forecasts suggest that by 2022, more than 90% of software providers will have transitioned to the subscription-based business model. On top of that, ever more tangible goods, such as furniture or clothing are offered as a flexible service for a reasonable monthly fee.

Anything-as-a-Service (or XaaS) can, quite literally, be anything and thus it isn’t hard to get lost in the jumble of buzzwords, jargon and concepts. This brief article will help you understand the idea of the new, service-based economy, discover the very bedrock of XaaS existence – cloud computing and recurring billing, find out how the SaaS model has evolved beyond software, and, finally, recognise some of the most promising opportunities and unprecedented challenges this phenomenon brings for both businesses and consumers. In order to explain the matter as clearly as possible, I’m using a case study of one of the most mainstream breeds of XaaS – Mobility-as-a-Service, leveraging insights from Straal’s recent report (PL version only). But let’s start with the basics.

What is XaaS?

Anything, or Everything-as-a-Service is a product distribution model, where companies instead of selling products, shift into providing value (until recently inseparably bound with their products) as a service. The cloud-enabled model is centred around a digital interface that governs the relationship between the provider and the user, seamlessly settles charges between parties, and, in the case of physical distribution, automates logistical dispositions. Although, the club of early adopters of the ‘as-a-Service’ approach to distribution consisted mainly of tech companies in need of a more sustainable way to sell software (SaaS), cloud infrastructure (IaaS) and application platforms (PaaS), it has soon been noticed and adopted by other industries.

Estimating the total value of the XaaS market is extremely hard due to its diversity and dynamics but researchers claim that the original trio of S-I-PaaS players generated an astounding amount of $122bn in pure recurring revenues over 2017, and is very likely to reach $174bn by 2022. After all, stunning profitability and predictability of revenue are the main advantages that encourage enterprises from roughly all segments of the market to transitioning from their traditional distribution models to the one based on access to value.

Transition to XaaS

Concepts such as renting or subscription-based commerce are neither new nor revolutionary. The recent rise of XaaS, however, is propelled by a number of socio-economic factors, as well as the growing technological maturity and popularisation of smart devices. The generational shift from Gen X to Millennials (and Gen Z waiting just around the corner) has brought a fundamental change in the social perception of ownership. Millennials prefer to experience/use/take advantage of rather than own/possess stuff. They are aware that most goods lose value really quickly but – at the very same time – despite having limited purchasing power, want access to all the cutting-edge tech advancements. You can read more about it in our recent report on MaaS (it’s in Polish, but you can grab some resources in English here).

In addition, the rise of new technologies such as AI, intelligent voice interfaces, or predictive data mining, has made it possible for businesses to push the value proposition of their services to the limits, thus rendering customers more likely to opt for an interconnected service, rather than a disconnected product. On top of that, the omnipresent mobile technology (there are more than 2.5bn smartphone users worldwide) has made online services accessible to virtually anybody.

The crossover of all of the above has given birth to a rapidly growing number of businesses launching XaaS solutions across a wide range of industries. Clothing-as-a-Service (Rent the Runway), Furniture-as-a-Service (Swivelfly), Car-as-a-Service (Book by Cadillac), or Energy-as-a-Service (GE has recently transitioned to ‘aaS’ by introducing its IoT fuelled platform – Pedrix) just to name a few. Even parents can now utilise data to monitor their baby’s sleeping patterns with Nanit. As a service, of course. So, what – besides the demands of always-broke Millennials – drives this flaming surge in popularity?

Win-win for both users and providers?

Apart from the right timing, there is an array of benefits for both parties involved in XaaS – the users and the providers – that placed the model on a skyrocketing trajectory.

First of all, the entry threshold has been lowered significantly. Depending on the product, the initial investment barrier could be barely a financial hardship (e.g. purchasing a light bulb) or a result of years-worth of savings (e.g. buying a vehicle). Furthermore, in the XaaS world, maintenance and uptime in on vendor, while the user can seat back, relax, and enjoy the journey.

Finally, the new form of services brings the flexibility of upgrading/downgrading the plan according to one’s needs with very little cost. Sales team getting bigger? No problem, just add another member to the CRM plan and an extra $5 will be charged seamlessly. According to Deloitte’s survey, 69% of organisations using XaaS solutions admit that they have recorded noticeable spikes in ROI and lower operational costs.

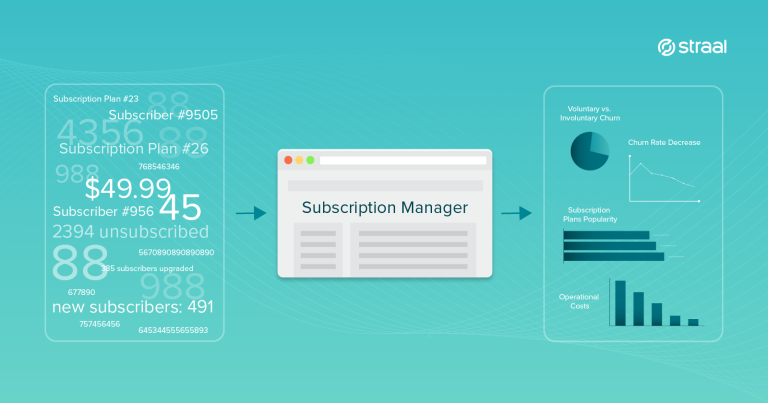

For businesses transitioning from traditional sales to ‘as-a-Service’ distribution, or simply, new players launching XaaS companies, the model, first and foremost, carries stability and predictability of revenue. Offering services brings a shift of focus from customer acquisition to customer retention, which has proven to be the number 1. business driver – 52% of CEOs say customer retention generates more revenue than anything else, followed by 42% of CEOs listing customer acquisition. As a result of that, steady cashflow dramatically increases predictability of monthly recurring revenue, and thus CEO’s ability to effectively shape the company’s business direction.

Furthermore, low entry barriers for customers present an opportunity to target much larger groups of users. Once a consumer has already became a customer, businesses can utilise a plethora of measures to monetise their value proposition, including upselling and cross-selling. This leads to a significant revenue boost and high scalability potential. According a survey of C-level professionals switching to XaaS business model – 83% of companies listed increased income as the top benefit of transitioning from product vendor to service provider. Not far behind, CEOs pointed the opportunity of going to new, international markets as the second (69%), and expanding beyond the company’s core market as the third (67%) main reason to switch to ‘as-a-Service’.

Of course, everything comes at a price (a small, recurring fee in this case) and XaaS is not without its flaws. Industry publishers list dependency on internet connection quality and lack of insight into provider’s infrastructure as the two main challenges associated with cloud-based services, but that barely scratches the surface of potential XaaS obstacles. The list of risks that might accompany that provider includes issues, such as fraud, building the right scale and corporate mindset, or high operational costs. You can find a more detailed analysis of XaaS challenges in the further part of this article, dedicated to Mobility-as-a-Service businesses.

Mobility-as-a-Service – a perfect XaaS case study

While software companies have started the XaaS trend, one of the most notable cases of ‘aaS’ gone mainstream is Mobility-as-a-Service. It is a perfect example of an industry that struggled with high entrance barriers in form of the initial investment, and therefore, costly customer acquisition. The companies that have decided to shift towards services have been booming for the past couple of years. Why? The answer lies at the cross section of the factors mentioned before – the generational shift, advancements in cloud and mobile computing, as well as an industry ripe for disruption. Let’s analyse the ins and outs of MaaS market, as an excellent example of XaaS.

What is Mobility-as-a-Service?

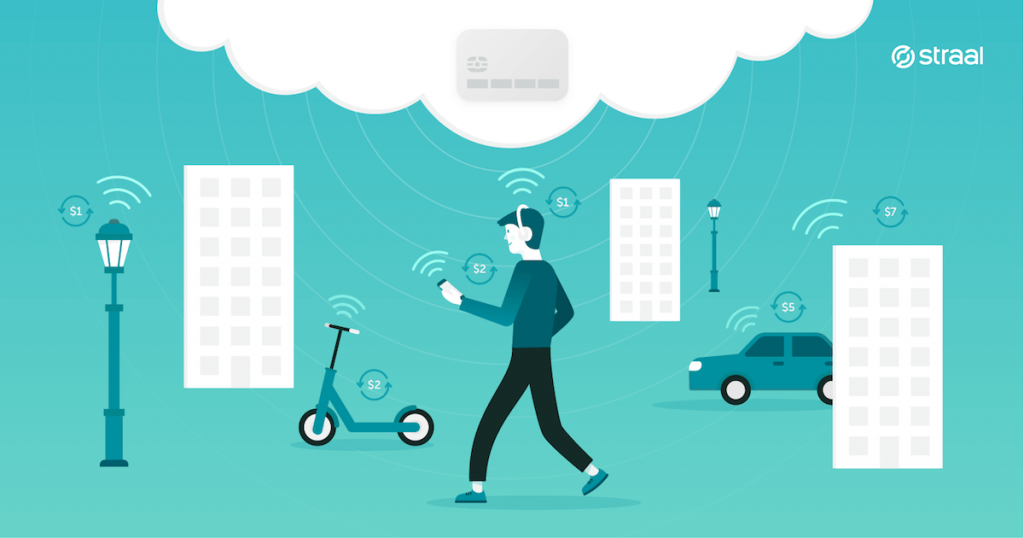

In a nutshell, Mobility-as-a-Service is a family of services associated with transporting individuals from point A to point B, while utilising a digital, cloud-based interface supported by automated payment settlement. MaaS rationale is based on the following premises: owning private transport is expensive, public transport is often ineffective and does not solve the ‘last mile problem’, the transportation industry has been ripe for tech-enabled disruption due to escalating traffic congestion in large urban areas, and its environmental aftermath.

The most popular types of MaaS include bike sharing (most notably in China – Mobike, and in Europe – Nextbike), ride hailing (Uber, Lyft, Taxify, Grab), car sharing (ZipCar, car2go, TrafiCar), ride sharing (Bla Bla Car), as well as the recent global phenomenon of rapidly scaling electric scooters (Bird, Lime, Bolt by Taxify, Jump by Uber, and many more).

Functioning of ‘as-a-Service’ transport

Tech-driven transportation can be divided into many subcategories, depending on, for instance, the type of payment, distance length, or open/closed distribution system, however, for the purpose of this post the adopted distinction will be customer’s involvement in transporting. Hence, the two main categories considered are platforms connecting drivers with passengers and vehicles available for self-contained transport.

Regardless of the category, the key element for all MaaS providers and users is the digital interface, based in cloud, ideally optimised for mobile and augmented reality use. It is that technology that enables location-based transport suggestions, optimised for route efficiency, price, convenience or a variety of other factors. In case of self-contained transport, the interface provides an insight into vehicle availability, serves as a tool to claim a vehicle, and automates the fee settlement. After all, there is no physical driver to handle the charges, hence the process requires full automation.

In the instance of platforms connecting drivers with passengers – the interface’s main task is to link the two parties while suggesting the optimal route and pricing. Fees settlement is often handled via the interface for convenience (mostly one-click card payments). This barely noticeable, seamless billing experience is a big contribution to the customer retention aspect, nonetheless, some of the biggest players like Uber, Taxify or Bla Bla Car, have been successful with implementing cash transactions on markets with low card penetration.

Opportunities for MaaS

Transportation has been an area that needed a tech-enabled disruption for a long time, with public transport being ineffective in many areas of the world, licenced taxi cabs having a monopoly on door-to-door transport services, as well as expenses associated with owning private vehicles.

All of the above have been influencing the shift to MaaS, and, along with the strengthening of the Millennial generation as the main economy driver, as well as the rise of an even more tech-centred Gen Z, the ‘aaS’ model will only continue to grow. According to Straal report, globally the number of car sharing users has been flourishing by 76% annually over the recent years. In Asia that growth has been even more impressive, with users growing at an astronomical 200% rate.

In addition, many MaaS companies are able to seek partnership with local governments in building their user base. One of the main rationales of offering tech-enabled transportation is solving the last mile problem, discharging the traffic congestion issue, and ultimately reducing the environmental footprint of human transport. This often goes in line with local government policies. One of the most notable examples of a successful government-MaaS cooperation is the public bike sharing system in Poland, subsidised by local councils and executed largely by a German bike sharing tycoon – Nextbike. City bikes have swiftly been winning the way to the hearts of Polish users, with more than 19.000 bicycles available for sharing at the moment.

Finally, it is worth mentioning the emergence of new transportation technologies, such as artificial intelligence, self-driving vehicles, smart appliances and other IoT advancements, will present new possibilities for Mobility-as-a-Service. One can only imagine how moving from point A to B will change over the next 50 years, however, according to the survey carried out for the purpose of the report, the awareness of such advancements in transport has already started spreading among consumers, with as many as 72% of subjects recognising the concept of self-driving cars.

Challenges for MaaS

Mobility-as-a-Service is not free from challenges to meet. In order to structure the analysis of MaaS potential obstacles, let us divide them into transportation specific issues, and general XaaS matters.

Starting with mobility, one of the main hardships is the constant struggle against regulatory bodies, trying to impose policies constraining MaaS legality. That is, of course, most prominent in case of ride hailing apps, but electric scooters or motor scooters are not far behind in the legislative game. The natural solution to that problem is lobbying efforts in case of big players. However, in case of enterprises with smaller lobbying budgets, effective cooperation with local governments, which shows that MaaS not only does not pose a threat to the society, but can also contribute to improving lives of a local community.

Another massive problem of tech-enabled transport is vehicle damage, a problem also tied to a broader spectrum of challenges – high operational costs. Considering damages, the correct, but a bit sluggish strategy, is education. The more users respect shared appliances, the less electric scooters will contaminate local pavements, lawns or rivers. When it comes to high operational costs, damaged vehicles are just one side of the problem, another is simply an expenditure of running a transportation business – fuel, drivers, or infrastructure. In the future, the rise of self-driving cars and popularisation of sustainable electric energy could solve at least a few of the operational issues.

A broader spectrum of challenges

Moving to the more general, XaaS-related challenges visible in the mobility sector, two headaches seem to be the most painful – building the right scale and controlling online fraud. Notice how building the right, not big, scale is problematic. Of course, in most cases – the bigger your company’s reach the better. However, quite recently, a Chinese bike sharing giant Ofo, brought itself near bankruptcy, by overestimating its scalability potential and running into cashflow hurdles. The best approach to smart scale building is partnering with flexible providers, offering solutions that facilitate global expansion safely – for instance, a GDPR compliant CRM, server host that can operate without geographic restrictions, or a multi-currency payment solution.

Payment fraud, on the other hand, is a challenge that needs no introduction and keeps a lot of CEOs awake at night. In order to avoid losses, chargebacks, unsatisfied customers, or even merchant account lockdowns, XaaS companies must incorporate fraud control deep into their business models. Start-ups and scale-ups who do not yet have the scale to fight fraudsters internally should choose partners who deliver fraud prevention mechanisms as a part of a bigger suite of features. More on effectively addressing fraudsters in one of our recent blog posts.

Final thoughts

We are moving towards a XaaS future faster than we think, with 61% of C-level professionals claiming they have already made some changes to their business models in order to adapt to the Everything-as-a-Service Economy. That is largely due to the technological and generational momentum, as well as the stability in predicting MRR and increased profits. But it isn’t just the providers that benefit from the transition. Users can enjoy the experience without worrying about maintenance and without the entry barrier in form of the initial investment. That is why so many businesses and consumers decide to use, rather than own.

Though today it is yet difficult to estimate the total worth of Anything-as-a-Service businesses, MaaS can serve as a perfect example of a successful industry transition that is gaining traction at an unprecedented pace. Among the main opportunities opening up before MaaS are emerging new technologies, such as self-driving cars, popularisation of environmentally sustainable energy consumption, and partnering with local governments.

However, tech-enabled transport is not without its challenges, main of which include high operational costs, regulative pressure, building the right scale and payment fraud. Nonetheless, each of these obstacles can be addressed with the right strategy, ultimately allowing the XaaS branch of the economic tree to bloom.

Who knows, maybe one day we will live in a world, where quite literally everything is offered as a service, each move, decision or activity will be tied to a seamless micro-transaction through an interconnected IoT interface. Maybe not really. But speaking of seamless transactions – read our recent blog post listing simple checkout and payment experience as one of the core business growth hacks.