The Mobility-as-a-Service market is one of the most prominent beneficiaries of the development of digital economy. Mobility apps have not only changed the way people commute but also how they pay for it. Increasingly often, payments affect the competitiveness of MaaS companies. What makes payment solutions so important for the MaaS industry, and what to mind while choosing a payment platform for a mobility system?

Defining Mobility as a Service

Mobility-as-a-Service, commonly abbreviated to MaaS, is a relatively new concept. MaaS Alliance defines it as a phenomenon of integrating diverse transport services into one available on demand. Understood this way, MaaS comprises categories such as public transportation, taxis, vehicle-sharing (e.g. cars, bikes, scooters), ride hailing, and vehicle rental.

Modern MaaS is bound with the online market and commonly available through mobile apps that serve as one-stop solutions for finding, ordering and paying for the service. What differentiates MaaS from traditional transportation is a shift in focus. In mobility apps, the starting point is the consumer need, i.e. the journey they want to make. In the past, it was the offering of a transportation company, its connections and destinations. These days are gone.

Europe, a former early adopter of MaaS, is the biggest mobility market right now. Market forecasts say it’s going to reach EUR €180 billion by 2025, and its huge potential tempts more and more startuppers to establish new vehicle-sharing companies (just think about electric scooters) or other MaaS enterprises. With the growing number of the mobility apps available on the market, one may wonder what makes some of them more successful than others.

Mobility Apps UX as a Game Changer

The Mobility-as-a-Service market has become fiercely competitive recently. “Electric scooter sharing Paris” returns 3,800,000 websites in Google, and the city already counts with more than 20,000 shared scooters!

You probably can’t help the feeling that the services offered by scooter-sharing companies are, basically, the same. Surely, they vary in terms of pricing, specific app features or the zones they are available in, but the core offering remains identical: they rent shared scooters. One of the key aspects making mobility systems different from each other are their apps, and to be more specific, app UX.

User experience is a critical aspect of all digital products offered on the saturated online market, no matter if they’re sold via websites or mobile apps (however, keep in mind that mobile optimization is not an option but a must). Just take a look at these statistics:

- UX is already becoming more relevant than the product and its price;

- 80% of users declare they’ll pay more for better customer experience;

- a customer is likely to share a positive online interaction with a brand with 4 to 6 people;

- when having a negative experience, customers are 88-percent likely to leave a brand;

- 90% of users say they have stopped using a mobile app due to poor performance.

As you can see, good user experience works like a magnet pulling users toward a brand and making them more engaged with it. By contrast, bad UX immediately deters them and pushes into the arms of your competitors.

Why Payments Are an Integral Part of Mobility Apps UX?

One of the biggest advantages of mobility apps over traditional transportation lies in the combination of convenience and speed. You order such services on the move, often in a hurry. What you expect is a quick purchase and a frictionless ride.

The same applies to payments. Mobility platforms have changed the way you pay for transportation services, replacing cash with online payment methods. Although some companies (mainly those offering ride-hailing) accept cash payments made at the end of the ride, some MaaS categories simply wouldn’t exist without online payments. Take vehicle-sharing as an example: the whole idea behind car-, bike- or scooter-sharing is self-service, which simply wouldn’t work without convenient online in-app payments.

The checkout integrated within the app is an integral part of mobility apps UX. To ensure best-quality user experience, MaaS providers should choose a payment system adjusted to the specific requirements of the MaaS category. Online payment systems are not equal: the offering of payment service providers vary in many aspects, which I will comment on in a moment.

Before moving on to choosing online payment systems for mobility apps, let’s take a look at some statistics showing the importance of checkout for online purchases in general:

- nearly 70% of users declare they would abandon an app if two many steps were involved (including checkout steps);

- simpler checkout increases conversion rates up to 35%;

- 54% of users demand seamless checkout experience across devices;

- 23% of users declare abandoning websites or apps due to too complicated checkout.

In the face of these findings, integrating a frictionless payment system is a must for mobility apps providers. What to expect from payment service providers? What features are essential for MaaS platforms? Below, I elaborate over some important aspects of choosing a payment system for all Mobility-as-a-Service market players.

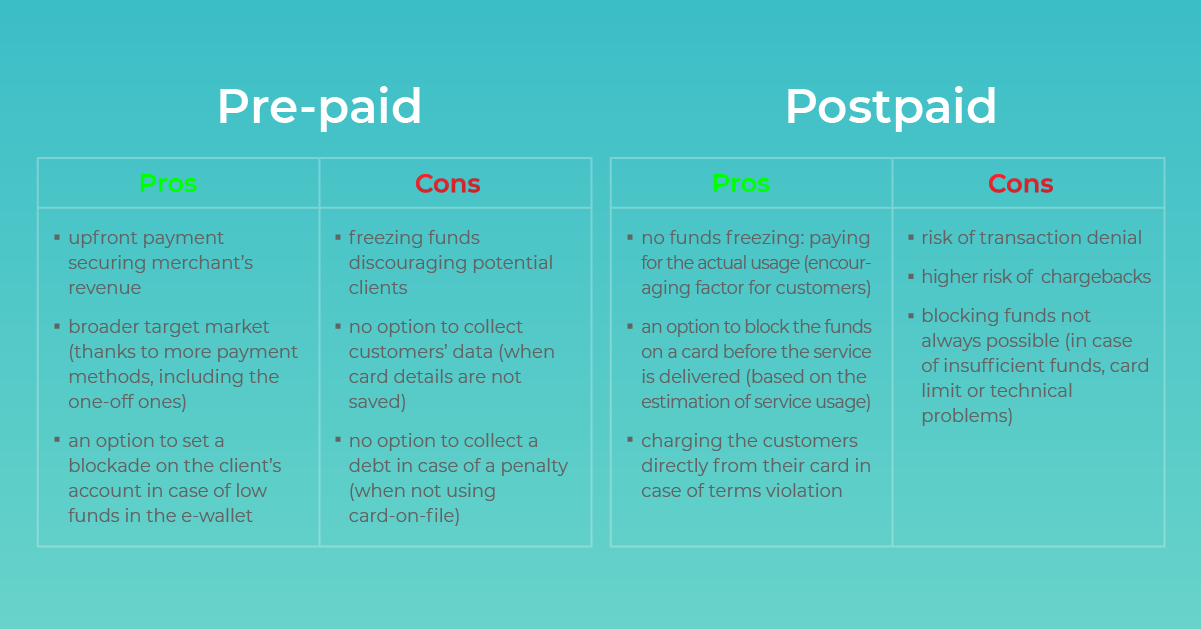

1. Billing Model: Choose Between Prepaid and Postpaid

The first question to ask when choosing a payment system for mobility apps is concerned with the billing model. There are two basic types of them:

- Prepaid in which the customer prepays an amount of money (usually, they’re preset) which is later used to pay for rides. The customer may utilize the service as long as the built-in digital wallet is not empty (or has sufficient funds to initiate a ride). It’s the same scheme that’s used in many European cities in public transportation: the passenger purchases a plastic card and prepays it when needed.

- Postpaid in which the payment is made after the service has been delivered (in most cases as it may also be ordered or booked). In this model, the customer sees an estimated price range of the ride before ordering the service and, once it’s delivered, pays for the actual usage. Postpaid is what we know from most mobility apps.

We described the pros and cons of prepaid and postpaid in detail

Now, due to increased convenience, the postpaid model is more popular on the Mobility-as-a-Service market, although some MaaS players predict that hybrid models importance will grow. Some mobility apps already offer them: they require users to add money to an in-app wallet to be used in case of insufficient funds on the saved card or if the user does damage to a vehicle.

2. Payment Methods: Minimize Checkout Steps

The second question to ask deals with the scope of payment methods to be integrated within your MaaS platform. As you probably know, the payment market offers myriads of them, but keep in mind that you definitely won’t need all of them.

What’s important at this step is that:

- you need to adjust the scope of payment methods you’re going to accept to your target countries as payment preferences differ locally (for more details check our entry about payment systems for international businesses),

- for the sake of optimal user experience, you should aim at simplifying the checkout process as much as possible, reducing the number of steps involved,

- it’s necessary to adjust the selection of payment methods to the chosen billing model as they are based on various methods.

While prepaid models utilize diverse payment methods such as Straal Direct, pay-by-links, bank transfers, and others, postpaid models require accepting card-on-file payments (where the card data is saved once and used for future purchases). The prevalence of the postpaid model on the MaaS market results not only from the convenience of paying afterwards but also from the popularity of cards that are the most popular payment method on the internet by now.

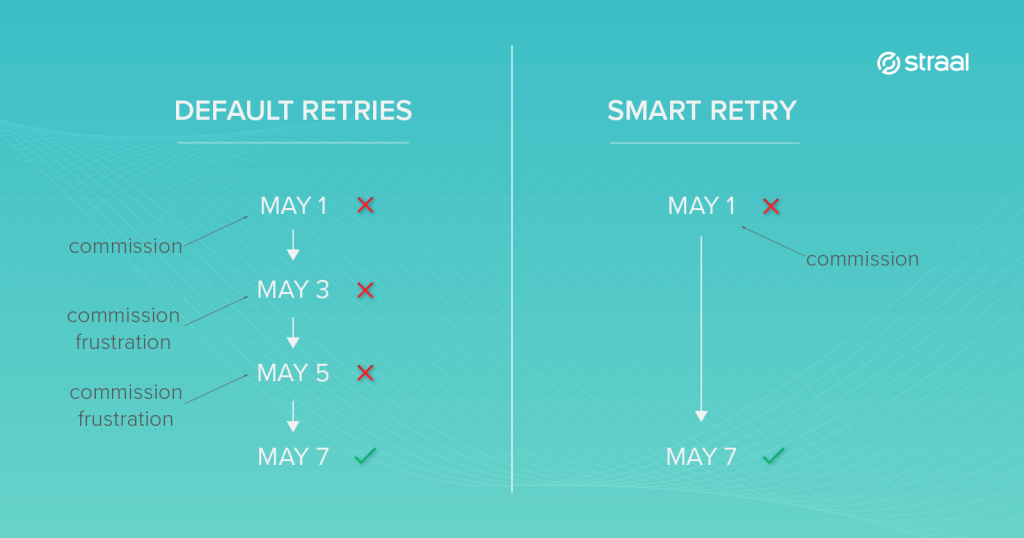

3. Smart Retry: Increase Card Approval Rates

If you decide to accept card payments (again, it’s necessary to implement the postpaid model), you’ll face the challenge of declined transactions. It may happen when:

- the funds on the card are insufficient,

- card limits have been exceeded,

- the card has expired,

- a technical error has occurred,

- the transaction seems fraudulent.

The problem is that MaaS platform owners pay commission for all transactions, even the unsuccessful ones. And, what’s obvious, when transactions are declined, they don’t generate revenue. From a single user perspective, both issues may seem minor, but when the revenue stream is based merely on card transactions and, say, 10% of them is declined, it becomes a major threat to the company’s financial liquidity.

The risk involved in card-on-file transactions can be mitigated effectively through the use of the Smart Retry solution. It’s an optimization tool aiming to increase the effectiveness of charging credit and debit cards after the first attempt proves unsuccessful. It may be used in all the cases mentioned above except for the last one (a fraud attempt is treated as a so-called hard decline). Applying Smart Retry results in a reduced number of charging attempts and, consequently, fewer declined transactions.

4. Payouts: Serve All Parties Within One Payment Ecosystem

In most cases, there are two parties involved in a MaaS system:

- your customers: those who order rides, vehicles, etc.,

- your partners: those who deliver their services to you, i.e. drivers (ride hailing), chargers (scooter sharing), etc.

You need a payment system for both of them, although these payment flows have opposite directions. Integrating two separate systems doesn’t make much sense as it generates additional costs, requires double integration, impedes payment data analysis and is simply inconvenient.

The best solution is to contract a PSP who enables both accepting payments from end-users and making payouts. Another important thing is how these payouts are made, i.e. with what payment method. In most cases, the best solution is making bank transfers (e.g. SEPA) directly to partners’ accounts. However, contractors may, at the same time, use your MaaS platform as end-users, i.e. order rides or share vehicles. It means they have saved their card data (in the case of postpaid billing) and may wish to receive payouts on it. As payment regulations let you, alternatively, make bank transfers to accounts to which the cards are attached to, choosing a payment method for payouts is an issue to consider.

5. Mobile Optimization: Don’t Harm Your UX

Mobile optimization is not an option anymore. It’s a must. Although everyone knows that outdated websites with small text one can hardly see discourage smartphone users effectively, statistics show that even 96% of them have seen websites that weren’t optimized for mobile devices at all.

Mobile apps don’t make use of hosted checkout pages, so MaaS providers have to create their own ones. What’s important in this context is what you get from a PSP: payment gateway documentation, its API, and mobile SDKs. They enable app developers to create payment experiences consistent with the rest of their mobility apps.

Just like the rest of the app, your checkout page should be fully optimized for mobile devices to make your clients’ payment experiences as smooth as possible.

Mobility Apps Benefit from Frictionless Payments and Payouts

Don’t disregard the role of the payment system for your MaaS platform performance. As I’ve proven in this entry, checkout is an integral part of all mobility apps with a huge impact on the overall user experience, and UX has the power to differentiate an app from the rest of the market. Also, you should remember about payouts, which should be an integral part of your app with transactions made within the same payment system.

At Straal, we believe that online payments are the foundation of modern mobility apps and that they fuel the development of the Mobility-as-a-Service market. We offer payment solutions adjusted to the uniqueness of this market but also individual characteristics of the businesses we collaborate with. To receive more information, contact our team at [email protected] and tell us about your business. Our specialists will get back to you and answer all MaaS questions you may have!