The decision to start selling internationally is a big step for every company. There’s much more strategic planning involved in the process than it may seem at first glance. One of the technical challenges that online merchants face is the choice of an international payment gateway. How to pick the right one? What features matter most when selling internationally? I’ve listed them for you.

Selling Internationally Pays Off

Everyone knows that e-commerce is growing, but not everyone is aware that the share of international online transactions is increasing as well. Taking Europe as an example, statistics show that almost ¼ of European online sales is already cross-border while 60% of online shoppers already make purchases on foreign websites.

Selling internationally may seem riskier than sticking to your domestic market, so why would you go cross-border? Just think about these aspects:

- you reach a broader range of customers easier because translating/localizing your offering takes less time than launching new product lines,

- your target group may be abroad because foreigners may have higher purchasing power or stronger needs,

- you may have less competition abroad as markets differ in terms of saturation,

- you diversify risk as you no longer depend on one economy’s condition.

However, it’s worth remembering that a successful expansion abroad hinges on the right selection of target markets. In-depth market research is required to choose the markets which are not only profitable but also relatively easy to enter. Based on it, your business development decisions translate into higher revenue.

International Payment Gateway is a Must

Once you’ve decided to enter the global game, technical issues appear, and they seem infinite. Before you decide on logistics or sales and marketing strategies, you should think about the basics: an international payment gateway. If you’re not familiar with this term, take a look at the entry where I explain it in detail: What is a Payment Gateway.

Surely, if you decide to sell abroad on Amazon, eBay or any other marketplace, you won’t have to worry about it, but this entry is about selling internationally on your own website, where you don’t have to share profits with big tech. Even if you make use of e-commerce software such as Woocommerce, you’ll have to choose the best international payment gateway, i.e. one that will let your customers carry out international online transactions effectively.

Essential Features of an International Payment Gateway

You’d obviously want to integrate the best payment gateway for international transactions, but what exactly should you look for? What features should the best payment gateway for international transactions have? Each market is different, but there are several common characteristics important for all customers.

I’ve already explained the most important features of payment gateways in general as well as those designed for subscription-based businesses. When selling internationally, online merchants face even more challenges, so the list of the desired features gets even longer. Let’s take a look at the features the best international payment gateway should have.

1. International Acquiring Connections

Gateways offering credit and debit card payments differ in terms of their acquiring connections (i.e. the acquirers they are connected with). What matters in the context of selling internationally is their number and the scope of services they provide.

There are basically four parties involved in most credit or debit card transactions:

- Payment Gateway: the entity enabling accepting payments on a website/in an app

- Acquirer (Acquiring Bank): the entity processing the transaction; it exchanges information about the transaction and the payer with the card scheme that issued the card used in the transaction

- Card Scheme (Card Organization): the entity gathering card issuers and acquirers; it is responsible for executing, managing and policing all transaction-related issues concerning the cards issued under its brand

- Issuer (Issuing Bank): the bank that has issued the payer’s card under the brand of a card scheme

As acquirers are the entities responsible for processing transactions, the offering of a gateway depends, to a high extent, on its acquiring connections. For merchants selling internationally, it is important to contract a payment gateway provider connected with acquirers processing transactions carried out in the chosen currencies (and, at the same time, offering specific settlement currencies; I’ll explain the difference later on) and with the use of the desired payment methods (section 3 explains it in details). Generally speaking, the more acquiring connections, the higher the chances of satisfying merchant needs.

Also, a payment gateway destined for international transactions should be equipped with Smart Routing technology aimed at maximizing the effectiveness of card transactions. When applied, the gateway makes data-based, context-conscious decisions as to which acquirer to choose for a given transaction to minimize the risk of its decline (if you want to know the reasons behind rejected transactions, take a look at Tomasz Kobylarz’s entry: Optimizing Card Payments: Smart Retry). Payment gateways having numerous acquiring connections and Smart Routing on board note the lowest rate of unsuccessful card transactions, especially the cross-border ones (they are more likely to be perceived as fraudulent than the domestic ones.)

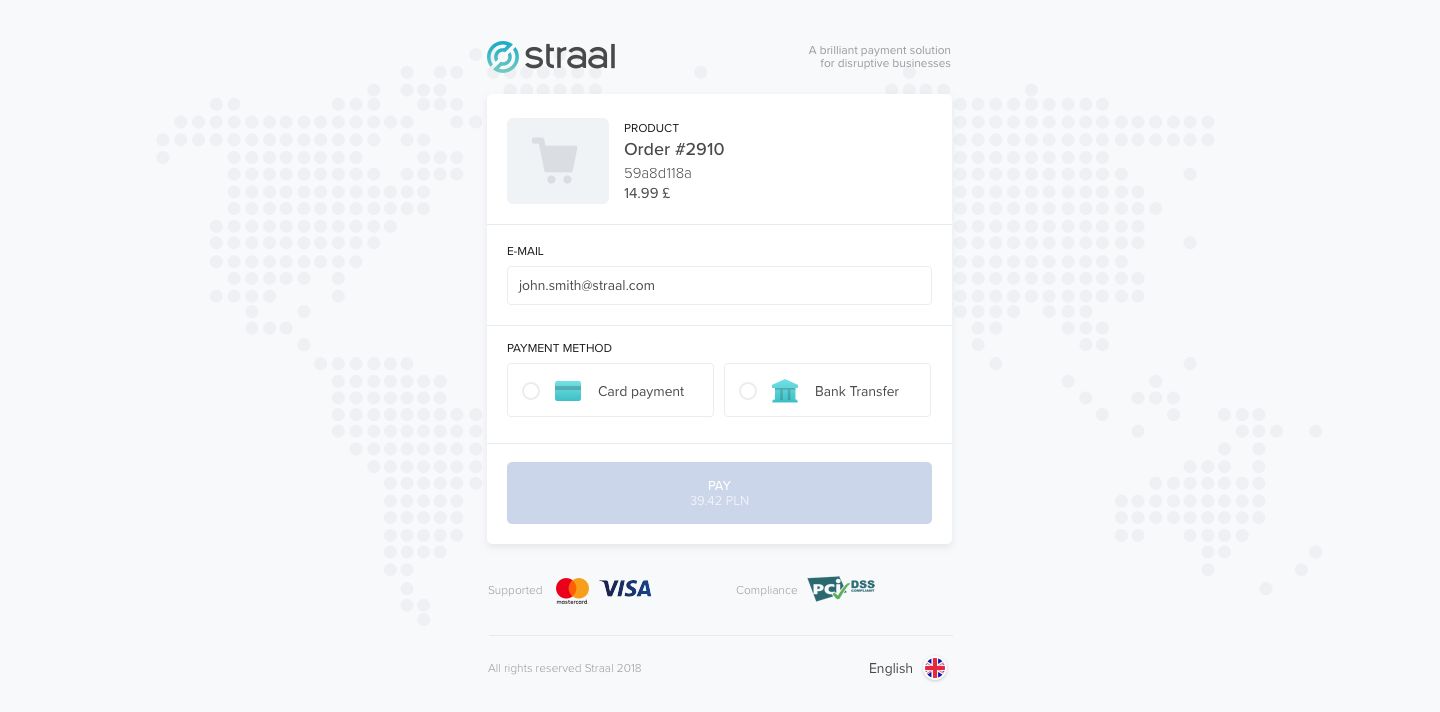

2. Geographically-Specific Choice of Payment Methods

Payment preferences vary by country, and the unavailability of one’s favourite method is likely to cause cart abandonment. For instance, German consumers choose SEPA Direct Debit very often, Italian e-shoppers like e-wallets, in Netherlands iDeal is very popular whereas the top Polish payment method is pay-by-link.

Before contracting a provider of an international payment gateway, research the markets you want to target. Are the payment preferences homogenous or diversified? What popular e-wallets (Google Pay, Apple Pay, etc.) are used there? Are there any local payment methods? Once answered, these questions will help you decide what payment methods to accept.

Remember that apart from local, geographically-specific payment methods, there are some universal options. For instance, credit and debit cards are the most popular online payment method globally. The cards of the two biggest organizations, Visa and Mastercard, are commonly used to pay online around the world, so accepting them is an absolute must. There are other methods that let you target multiple markets in the region. For example, Straal Direct – our original payment method based on open banking – is a way to reach customers in a large number of European Economic Area countries (all the payer needs is a bank account with e-banking available.) It’s easy to use and has no chargeback thresholds, which is especially important in the context of risk management.

When choosing the best international payment gateway, remember that it is not the number of payment methods that matters as you most likely won’t need all of them (let alone the fact that PSPs often treat card brands as separate methods, which is basically not true but can also affect the conversion in a given market). What is important is to accept methods used in your target countries. Also, keep in mind that giving your customers some choice will make them more satisfied and keep your conversions high.

3. Transaction Currencies Adjusted to Target Markets

When looking for the best payment gateway for international transactions, you should also think about currencies. In the context of online payments, we can distinguish two types:

- Transaction currency is the one your customers see in your e-store/app. No matter the currency of their cards or accounts, they are charged in the one displayed on the website. For instance, if your product costs EUR 100, but your customer from the UK uses a credit card in GBP, they will still be charged in euros. The foreign exchange rate and other fees will be decided by the card scheme and the issuing bank.

- Settlement currency is the one in which the revenue generated by your e-store/app is wired to your bank account. If the settlement currency and transaction currency differ, the foreign exchange rates and other fees are typically decided by the acquirer.

The settlement currency is surely an issue to consider, but what’s really important from the consumer point of view are your transaction currencies. Prices displayed in foreign currencies may be confusing as not everyone is familiar with FX rates and, more importantly, not everyone is patient enough to calculate the final price. As mentioned earlier, when you sell abroad in your domestic currency, you create the extra cost of foreign exchange. Your customers would definitely prefer to avoid it.

Countries also vary in terms of VAT (GST or sales tax) rates, and the customer shouldn’t see prices that include a rate not applicable to their region. One should not neglect these differences as they may be significant: for instance, the standard VAT rate in Hungary is 27% while in Luxembourg it’s only 17%.

Look for an international payment gateway offering a wide scope of transaction and settlement currencies. Thanks to that, you’ll sell abroad with a considerably low cart abandonment rate.

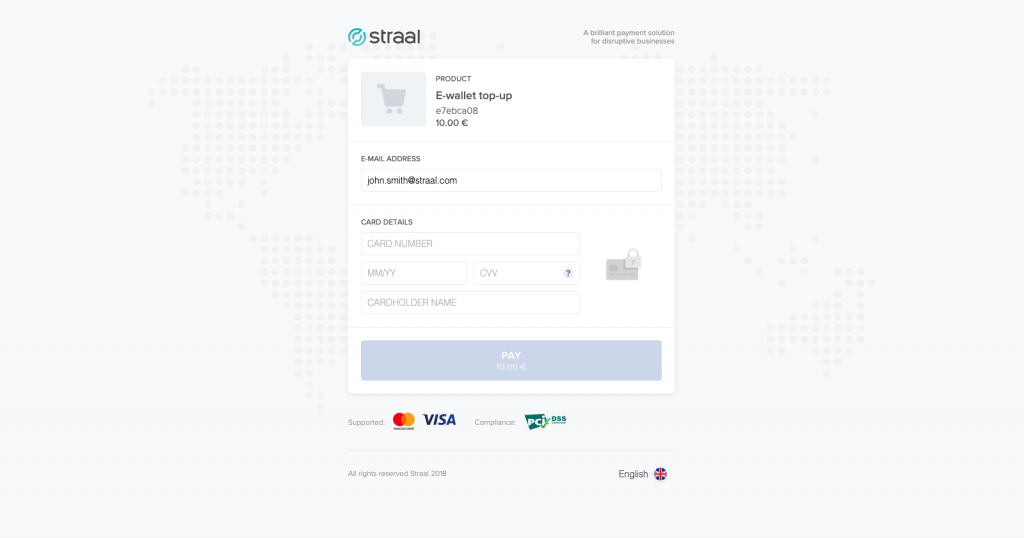

4. Fully-Translated Checkout Pages

Have you ever tried to make a purchase in a foreign e-store, but when you clicked the ‘Buy’ button, you were redirected to a checkout page in a different language? Maybe you even abandoned this page? Some Asian marketplaces are infamous for either not providing checkout pages in European languages or having ones with poor-quality translation (internet users love to make fun of them.) Remember that any minor error on your checkout page – be it a typo or a translation error – decreases the credibility of your website and, thus, increases the likeliness of your customers abandoning it.

There are two types of checkout pages: integrated and hosted. If you decide to use the first one, you are free to design your own. In this case, remember about providing proper translations (I suggest avoiding machine translation – as of today, they’re not really accurate).

However, if you decide to use a hosted checkout page, it’s the international payment gateway provider who’s responsible for providing translations. Ask your potential provider about the available languages and, if possible, check their quality.

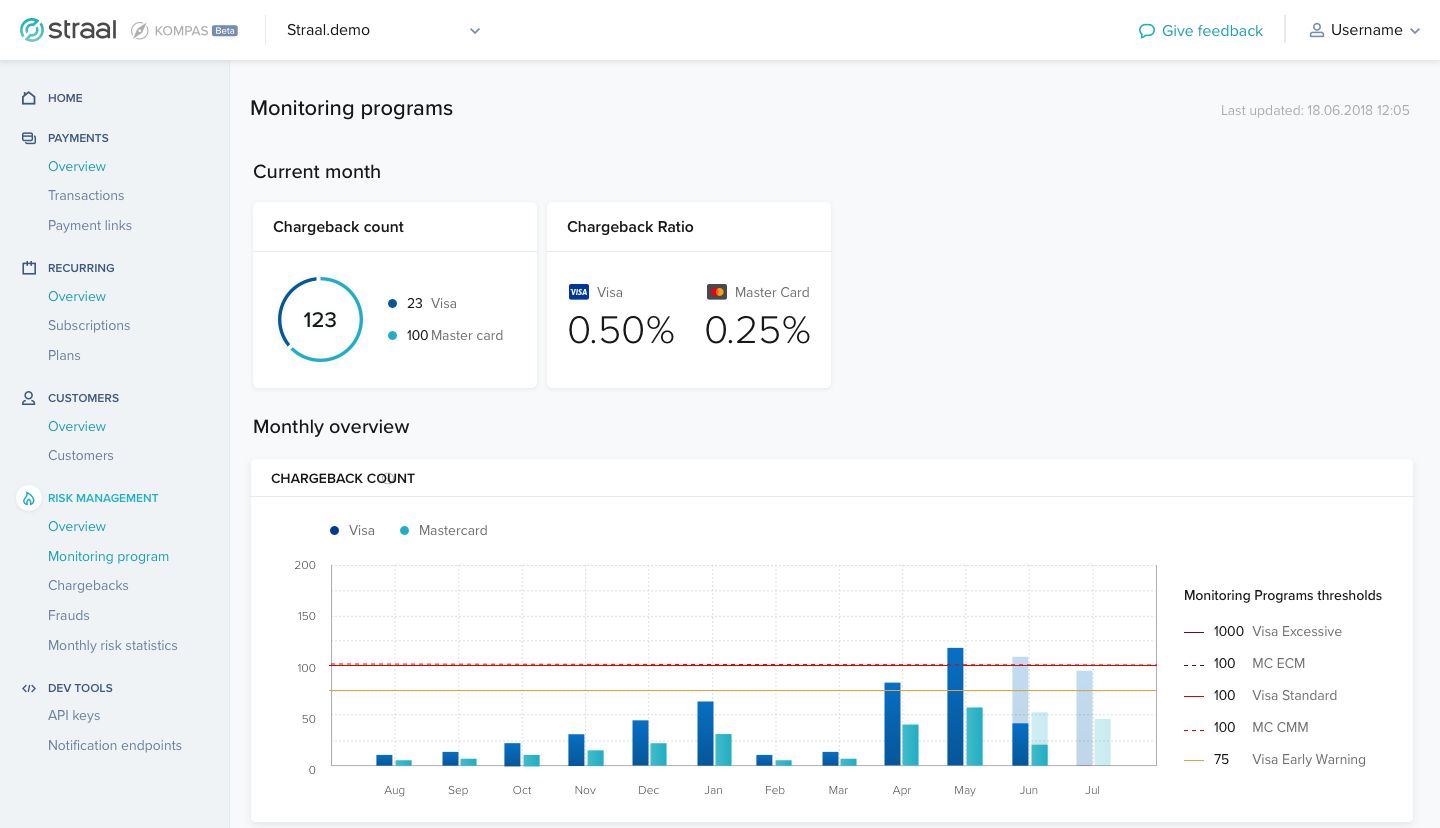

5. Sophisticated Anti-Fraud Tools

Companies that sell abroad are more exposed to payment fraud than the ones operating on their domestic markets (if you’re not sure what payment fraud is, check out this article by Tomasz Kobylarz: Your Business in the Face of Fraud). Merchants selling internationally experience fraud even 2.5 times more often, as LexisNexis reports.

Some countries are considered high-risk: when selling your products on these markets, you are more likely to fall victim to fraud. Checking the average chargeback rates of the countries you’re interested in beforehand is a good idea.

When looking for the best international payment gateway, pay attention to its anti-fraud solutions, especially if you consider entering high-risk markets. Efficient FDP systems are a must for merchants selling internationally. They minimize your spending on disputes and risk management.

Expanding with Straal: Our International Payment Gateway

At Straal, we believe that cross-border sales is the future of e-commerce. We support merchants who sell abroad, offering online payment solutions adjusted to the needs of international business.

With our international payment gateway, having more than 200 acquiring connections and Smart Routing on board, you can accept cards of the world’s major organizations (such as Visa and Mastercard, and more), popular direct debits (such as SEPA DD), and local payment methods (e.g. pay-by-links and BLIK). Our portfolio also includes Straal Direct: a new payment method based open banking that lets you target all EEA markets easily and securely (direct bank-to-bank transfers). We support more than 150 transaction currencies and make use of our hosted checkout pages translated into 20 languages. Finally, our payment gateway is equipped with a sophisticated anti-fraud system leveraging machine learning, pattern recognition, and user profiling to help you detect and prevent payment fraud as efficiently as possible.

If you want to learn more about our product, take a look at our website or contact our team. We will be happy to help you find the best payment solution for your international business!