Prepaid or postpaid: that is the question. Which payment model should you choose for your business to simplify user experience and boost the company’s revenue? Should your customers add money to an e-wallet and be limited by the amount paid upfront or be charged after every single use of your service? In this blog entry, I compare both approaches using the Mobility-as-a-Service industry as an example.

Charging for the Actual Usage – Prepaid vs. Postpaid

Let’s start with the basics. Payment solutions tailored to your business needs are indispensable to increase your business performance. When choosing your monetization tools , focus on your product and the needs it satisfies. Consider your customers’ profiles as well. One of the key questions to be answered is if they purchase your merchandise regularly or just occasionally?

If you’re operating in the Mobility-as-a-Service industry, you’ve probably noticed that some users don’t want to pay a fixed fee for a service they use only from time to time. That’s why the pay-as-you-go model is dominating this market right now. However, the results of the recent commercial experiments carried out by Uber and other global players suggest that, in the future, the pay-as-you-go model might be displaced by hybrid solutions .

In the context of Mobility-as-a-Service, the prepaid and postpaid models denominate repetitive, yet irregular transactions. What are the differences between these two approaches? Scroll down to find out.

How Prepaid model works?

Let’s start with a brief explanation of how the prepaid model works in the MaaS industry. Mobility service apps have built-in digital wallets to which users prepay a chosen number of units (usually, service providers impose pre-set amounts to choose from, e.g. $5, $20, $50). Then, they’re able to use the service until running out of balance. After each use of the service, the number of units added to the wallet is reduced by the amount representing the actual usage (e.g. the ride distance or time spent in a vehicle). The easiest way to illustrate this process is to compare it to car fuelling. As long as there is petroleum in the tank, your client has the right (and possibility) to drive but once the fuel runs out, they have to top it up.

As a mobility service provider, you can also equip your app with an auto-top-up feature that will automatically add some units to the app’s built-in wallet when your customer’s balance runs low. Besides charging a card (where card data is saved thanks to the card-on-file technology), the user can add money to the wallet using Straal Direct, pay-by-links, bank transfers, and other payment methods (if these terms don’t ring a bell, read our guide: 5 Things You Should Know about the Payment Ecosystem).

Pros and Cons of Prepaid model

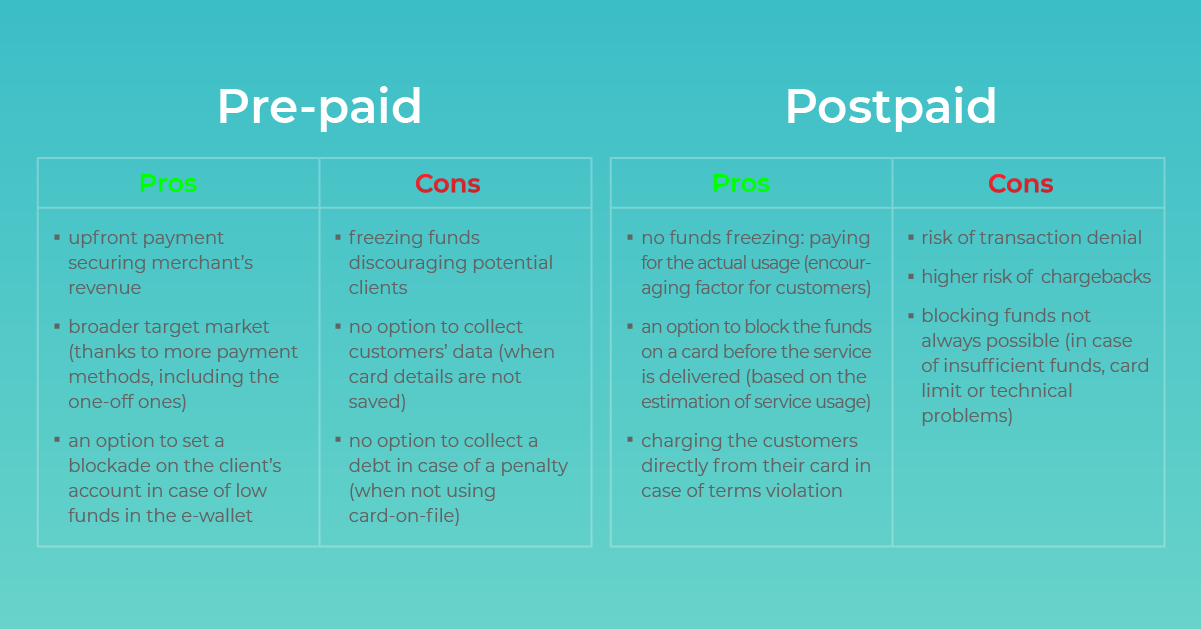

The biggest advantage of the prepaid model is its predictability. Once your customer adds funds to the wallet, there is no possibility of withdrawing this money. Thanks to that, you collect the payment before the service is initiated. Another benefit of prepaid systems is that they work with various payment methods, not only with cards. This translates into a broader range of potential customers (all in all, not all of them may be willing to share their card data).

Nonetheless, the prepaid model also presents certain challenges. One of those is the fact that you can’t foresee the final price your customer will have to pay after the ride. Let’s take electric scooter rental as an example: if your client has some money in the wallet, the ride can be initiated. However, the final price may exceed the number of units at their disposal. This may jeopardize smooth charging and affect your business’s revenue stream. To avoid this situation, you can collect the remaining sum directly from the user’s account whenever the card-on-file payment method is used. Yet, if you enable choosing another method, you must be aware that an uncontrolled usage of your service may take place, the outcome being a minus balance of your customer’s e-wallet. If they don’t use your service again, you won’t have a chance to get your money back (or the process of regaining it might be very expensive). On the other hand, if your clients do want to use it again, they’ll be obliged to pay the remaining sum first. All in all, the best choice is to protect your business beforehand, opting for the card-on-file payment method. Another solution is to set a higher limit of funds needed to use the service. As a result, a client willing to initiate another ride will be forced to add more funds before starting it. Nonetheless, you should remember that when your client is in a hurry, the obligation to refill the wallet may seem annoying. Blocked access to one’s funds may also be frustrating, which is harmful to your UX.

How Postpaid model works?

In this model, unlike in the prepaid one, the payment is made after your service is delivered, ordered or booked and the user is charged based on its actual usage. In this case, using the card-on-file method is necessary. In ride-hailing services, for instance, the passenger orders a vehicle and is informed about the estimated price (or price range) of the trip before it starts. Thus, they don’t have to worry that the driver will take a longer route: looking impatiently at a taximeter is a thing of the past! The only thing the customer should care about is the availability of sufficient funds on the card saved in the app or their credit card limits.

Pros and Cons of Postpaid model

First of all, the post-paid approach doesn’t require any upfront payments, which is more convenient from the customer’s perspective. Post-paid is based on charging funds directly from one’s card so you don’t have to worry about the solvency of your customers (apart from insufficient funds or potential technical problems occurring on the bank’s side). What’s more, one-click payments ensure customers that they’ll be charged only for the actual usage of the service. Thanks to that, they’re typically more willing to make use of it. Another advantage of the post-paid system is that card details saved on file allow charging users for possible damage done to the vehicle or other violation of terms & conditions.

In the context of postpaid’s drawbacks, it’s worth mentioning the chargeback risk, a major concern of online merchants and service providers. The card-on-file technology makes it possible for an unauthorized individual to use someone else’s card to initiate a transaction. The problem may be solved through the use of additional authorization layers such as SMS codes or fingerprint scanning in your application. What if – once the service is delivered -it turns out that your client does not have sufficient funds on their account?t? Well, you need to retry the transaction later and, in the worst-case scenario, claim the debt using traditional methods. Fortunately, situations like this can be prevented from happening. You can implement a pre-authorization for the cost of the service (like in the case of Uber) or for the amount ensuring the delivery of most services (electric scooter case). For failed payments, you can also consider an option to retry failed transactions using Straal’s Smart Retry.

Choose the Best Solution for your Business Model

Which approach provides a higher conversion rate for your business? It all depends on your business model, the nature of your service, and your target market. If you’re operating in a sector where card payments are not popular, consider implementing the prepaid system. The postpaid model is suited for almost every market except those where customers avoid using cards.

Decide which solution meets your business needs best. If your clients’ payment preferences are not clear, let them choose. Don’t forget about subscriptions, another option the MaaS sector: this settlement model is increasingly popular because it brings stability and predictability, which makes companies develop hybrid models combining subscription plans with payments for actual service usage.

Remember that it’s crucial to integrate your app with a reliable PCI-certified payment gateway in order to enable secure access to multiple payment channels.

Still got questions? Feel free to ask them at [email protected]!